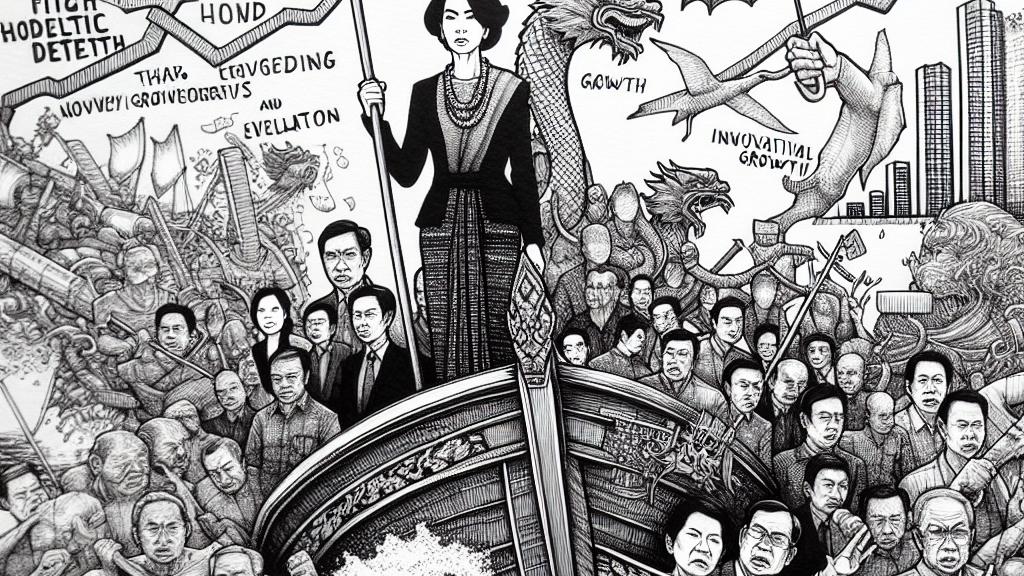

Thailand's New PM Ready to Rumble: Rate Cuts and Central Bank Clashes Ahead!

Overview

- Paetongtarn Shinawatra's leadership marks a critical juncture for Thailand's economy.

- Intensified demands for lower interest rates from the Bank of Thailand pose significant challenges.

- Historical patterns suggest potential tensions between the government and the central bank.

Economic Challenges in the Wake of Leadership Change

As Paetongtarn Shinawatra assumes the role of Prime Minister in Thailand, the nation faces pressing economic challenges that necessitate urgent attention. The economy, while demonstrating some recovery with a growth rate of 2.3% in the second quarter, still struggles with underlying issues such as high household debt and the need for sustainable growth strategies. The new PM's proposal for a 145-billion-baht cash handout aimed at stimulating consumption has raised eyebrows, as it could exacerbate fiscal deficits and conflict with the Bank of Thailand's monetary policies. The Shinawatra family's political legacy complicates this situation, having historically used economic strategies to bolster their populist positions, often leading to friction with monetary authorities.

The Bank of Thailand's Role and Emerging Pressures

The Bank of Thailand (BoT) is currently caught between maintaining its conservative monetary stance and responding to increasing pressure from the newly formed government led by Paetongtarn Shinawatra. Many economists forecast that the BoT will keep its policy rate steady at 2.5% for the fifth consecutive meeting; however, the calls for rate reductions are mounting as the government seeks to stimulate the economy further. Key analysts highlight concerns over the implications of the proposed cash handout on inflation and household debt, which is already precariously high. The central bank's insistence on maintaining its inflationary targets and protecting the baht reflects its commitment to long-term stability rather than short-term political gains, setting the stage for possible conflicts ahead.

Navigating a Legacy of Tension and Future Prospects

The tension between Thailand's political leadership and the Bank of Thailand is a well-documented phenomenon, particularly in the context of the Shinawatra family's political history. Past administrations have faced scrutiny and resistance from the BoT over their attempts to influence monetary policy for populist purposes. As Paetongtarn navigates this landscape, expectations are high not only for her ability to revive Thailand's economy but also for her approach to managing relationships with the BoT. Observers are keen to see whether she will continue the trend of her predecessors, who squeezed the central bank for immediate results, or approach governance in a way that acknowledges the importance of independent monetary policy for long-term stability. Ultimately, her success will depend on striking this delicate balance while addressing the pressing needs of a recovering economy.

Loading...