Understanding Deutsche Bank's Fourth Quarter Profit Drop

Overview

- Deutsche Bank's Q4 2024 profit shockingly decreases.

- Net profit drops to an alarming 106 million euros, far below expectations.

- This drastic shift raises serious concerns about the bank's future stability.

A Sudden and Alarming Decline

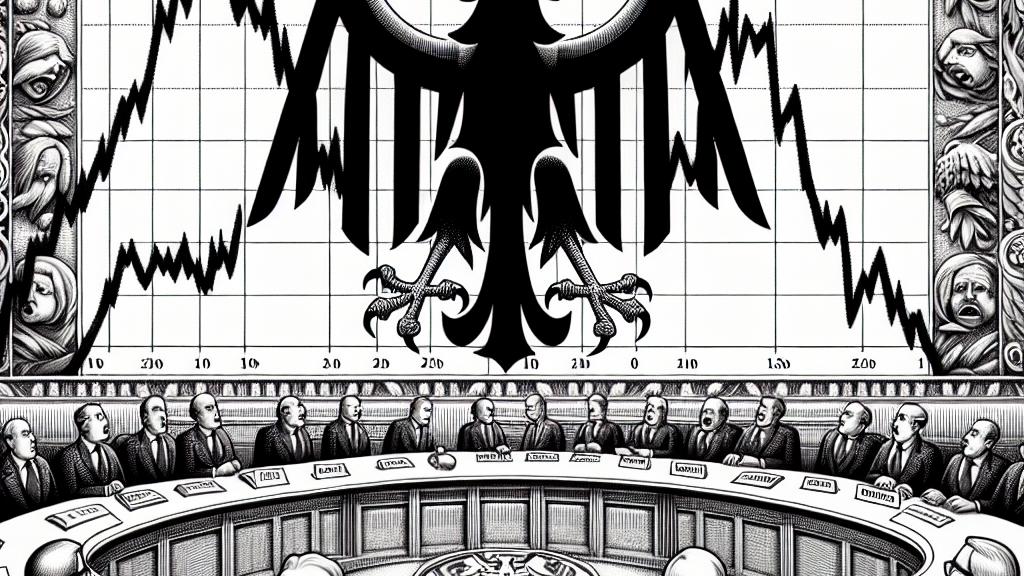

In an unexpected turn of events, Deutsche Bank—Germany's largest lender—reported a staggering decline in its net profit for the fourth quarter of 2024. Falling dramatically to just 106 million euros, this figure starkly contrasts with the impressive 1.461 billion euros achieved in the third quarter. To put this in perspective, analysts had confidently predicted profits in the range of 282 million euros. This shocking deviation from expectations leaves us questioning: What could have led to such a steep decline in profitability? Is it merely a blip, or are underlying issues lurking beneath the surface?

What This Means for Investors

For investors, the implications of this profit drop could be significant and far-reaching. Alongside the profit decline, revenue figures also fell short, reaching only 7.224 billion euros compared to the expected 7.125 billion euros. Even though it slightly beats predictions, it isn’t enough to mask the grim reality of the profit drop. Shareholders might find themselves on edge and questioning their investments. The critical question arises: What does this mean for future stock performances? Maintaining confidence in Deutsche Bank's financial stability will now demand immediate and transparent efforts from its leadership to address these challenges.

Drawing Parallels with Previous Successes

Reflecting on Deutsche Bank's recent history provides even more context for understanding this situation. In 2023, the bank proudly announced a remarkable pre-tax profit of €5.7 billion, complemented by a solid 6% growth in revenue year-over-year. This illustrated a narrative of resilience and strategic success. Now, just a few months later, the stark contrast illustrates how quickly fortunes can change in the banking world. The sudden downturn serves as a potent reminder of the volatility inherent in financial markets. It brings to light the need for vigilance and adaptability amid uncertain economic conditions.

Strategies for Recovery and Rebuilding Trust

Looking ahead, Deutsche Bank faces the daunting task of not only recovering from this disappointing quarter but also positioning itself for sustainable growth. To rebuild trust among its stakeholders, the bank must adopt a nuanced strategy that includes improving operational efficiencies, carefully managing costs, and potentially diversifying its revenue streams. Additionally, clear and consistent communication will be paramount. Stakeholders want reassurance. They want to know: What steps will the bank take to ensure that this profit drop is a temporary setback? By focusing on transparency and proactive measures, Deutsche Bank can work towards not just weathering this storm but emerging stronger and more resilient.

Loading...