Opposition in India Demands Investigation: SEBI Chief Caught in Adani Scandal!

Overview

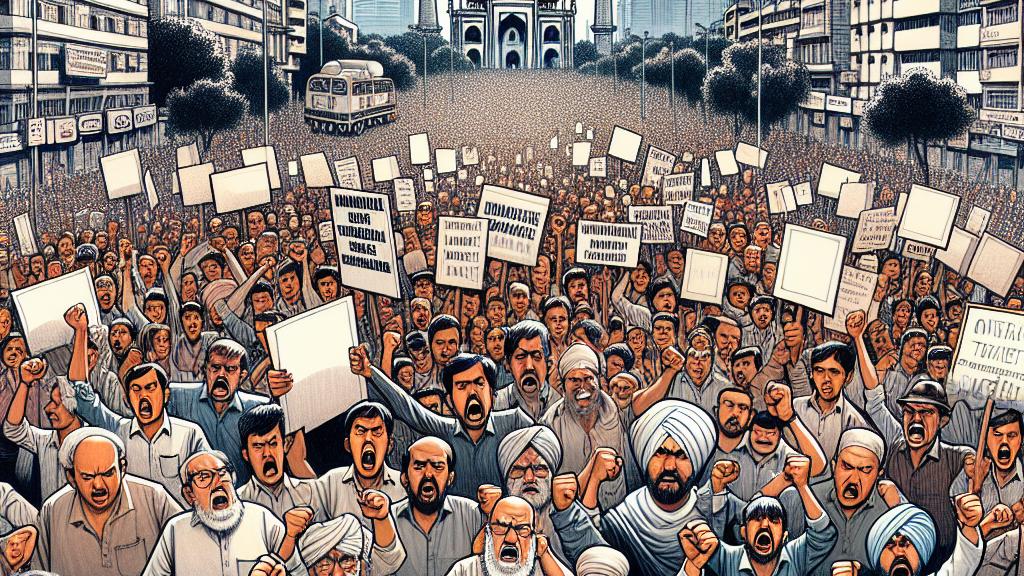

- Nationwide protests in India against SEBI's involvement in the Adani Group scandal.

- Madhabi Puri Buch faces allegations of conflict of interest amid Hindenburg Research accusations.

- Calls for a parliamentary probe highlight potential risks to market integrity and investor trust.

Context of the Protests

A wave of protests has swept through India, with thousands of supporters from various opposition parties rallying in major cities, including New Delhi, Mumbai, and others. The uproar is primarily directed at the head of the Securities and Exchange Board of India (SEBI), Madhabi Puri Buch, following explosive allegations made by Hindenburg Research against the Adani Group. These claims suggest that the Adani conglomerate may have engaged in serious financial misconduct by using tax havens to bypass domestic regulations, resulting in a staggering loss of $2 billion in market capitalization. As citizens display their discontent, the protests underscore a critical moment for India's financial oversight system, raising alarms about the integrity and accountability of regulatory institutions.

Key Allegations and Political Response

At the heart of the unrest is the assertion that Buch's investments in an offshore fund, linked to the Adani Group, constitute a conflict of interest that compromises her ability to conduct impartial oversight. Prominent leaders from the Congress party and other opposition factions are demanding her resignation and urging the formation of a parliamentary committee to conduct a thorough investigation into the allegations. Despite the opposition's push for accountability, Prime Minister Narendra Modi's government appears hesitant to initiate an inquiry, suggesting instead that it may reconsider Buch's position as her term approaches its expiration in March 2025. This situation reflects wider concerns about cronyism, as Gautam Adani, the group's founder, is known to have close ties with Modi and his ruling party.

Implications for Investors and Market Oversight

The protests signify a pivotal moment for investor confidence in India's capital markets. Opposition figures, including Congress's Sachin Pilot, have voiced concerns that the ongoing situation is eroding trust in SEBI, potentially destabilizing the financial landscape. The combination of government reluctance to investigate and the serious nature of the allegations against the Adani Group could lead to broader implications for corporate governance and market stability in India. If a parliamentary investigation is launched, it could pave the way for necessary reforms aimed at bolstering transparency within financial institutions. The situation calls for a reevaluation of the mechanisms that ensure accountability and fairness in the market, reflecting the aspirations of Indian citizens for a more trustworthy economic environment. The outcome of these protests could ultimately reshape the landscape of regulatory practices in India, reinforcing the critical role of oversight bodies in maintaining market integrity.

Loading...