Warnings of a Tech Exodus in Britain Due to Proposed Tax Changes

Overview

- Proposed tax hikes could push tech entrepreneurs out of the U.K., sparking serious concern within the industry.

- Finance Minister Rachel Reeves plans major tax reforms that may reshape the country’s startup landscape.

- Over 500 entrepreneurs are advocating against these changes, fearing negative impacts on innovation and growth.

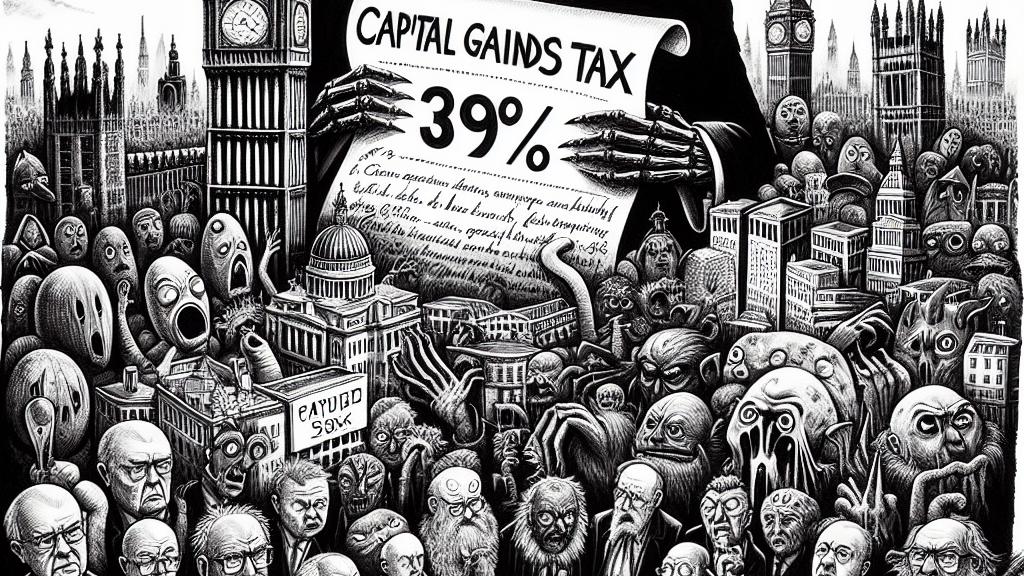

Concerns Over Capital Gains Tax Hike

London is buzzing with anxiety as reports emerge about upcoming changes to capital gains tax (CGT). Finance Minister Rachel Reeves is reportedly considering raising the CGT—taxed on profits from asset sales—potentially up to an alarming 39%. Such a significant increase could compel numerous tech entrepreneurs to contemplate relocating their businesses to countries with less punitive tax structures. For comparison, the potential hike could position the U.K. with the second-highest CGT rate in Europe, which would send a troubling signal to investors and innovators alike. If enacted, this change could destabilize not only the financial landscape but also undermine the vibrant tech ecosystem that has flourished in recent years.

Entrepreneurial Response to Tax Changes

In a powerful show of unity, more than 500 entrepreneurs have penned an open letter to Minister Reeves, expressing their collective concerns fervently. Their message is clear: raising the CGT and restricting business asset disposal relief (BADR) would suffocate the entrepreneurial spirit that fuels economic growth. With prominent figures such as Giles Andrews, co-founder of the innovative digital bank Zopa, and Rishi Khosla, CEO of OakNorth, among the signatories, the call to action is loud and compelling. They emphasize that such tax measures might trigger an unprecedented exodus of talented entrepreneurs, seeking more hospitable environments where their contributions are recognized and valued, highlighting that this could lead to a decrease in overall tax revenues for the government.

Implications for Britain's Tech Future

The stakes for Britain's tech future have never been higher, and the implications of these proposed tax reforms could be dire. Analysts are raising alarms about the likelihood of a 'tech exodus,' drawing parallels to what occurred in San Francisco, where high costs and stringent regulations have driven numerous companies and talent away. This is not merely an economic issue; it's about the very lifeblood of innovation. As Adam French, a partner at Antler, points out, 'The decisions made today could ripple through our economy for years to come.' If the proposed tax reforms are enacted, they risk stifling creativity and entrepreneurship, potentially altering the narrative of the U.K.'s tech landscape entirely. What could have been an era of growth and opportunity might instead turn into one of caution and retreat for aspiring tech leaders.

Loading...