Challenges Facing China's SMEs Amid Economic Recovery

Overview

- China's SMEs are facing significant liquidity challenges that hinder their growth.

- The recent decline in the SME Development Index highlights deep-rooted economic struggles.

- Government initiatives seek to enhance SME funding and boost overall competitiveness.

The Ongoing Struggles of SMEs

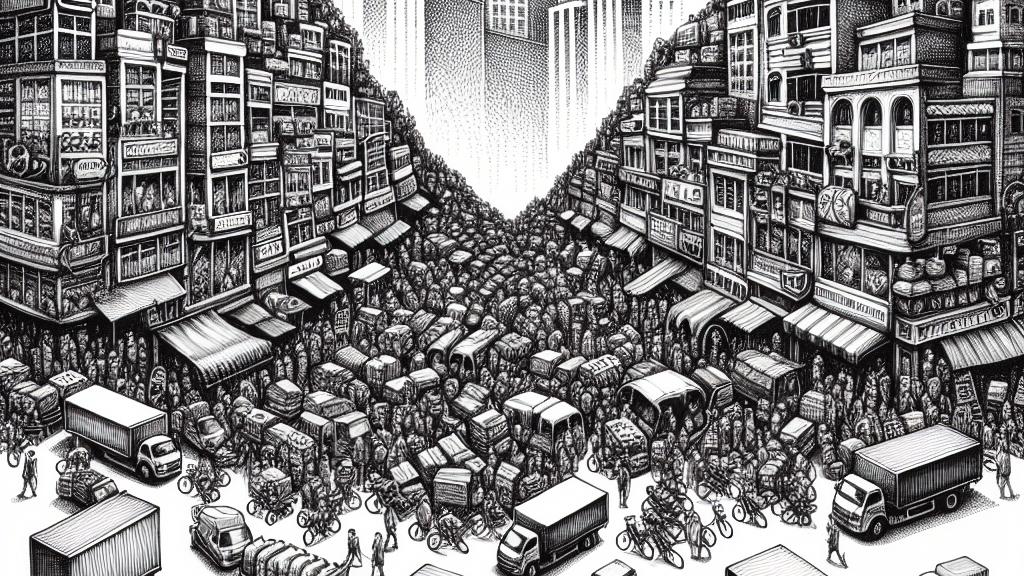

In the heart of China’s bustling economy, small and medium-sized enterprises (SMEs) are grappling with immense challenges as they strive to recover from the lasting effects of the COVID-19 pandemic. According to a revealing survey conducted in September 2024, the SME Development Index plummeted to 88.7, the lowest level recorded in a year and a stark contrast to the pre-pandemic average of 92.9. This alarming decline not only reflects the bumpy road to recovery but also underscores a more troubling trend: many SMEs are finding it increasingly difficult to navigate a landscape filled with uncertainty. With supply chain disruptions affecting manufacturing capabilities and shifting consumer preferences creating additional pressure, these businesses are under constant strain to remain afloat in a volatile market.

Government Support Initiatives Unveiled

In response to the persistent struggles faced by SMEs, the Chinese government has rolled out a series of innovative support measures aimed at revitalizing this crucial sector. Notably, guidelines introduced in late 2021 focus on the enhancement of credit support, the strengthening of intellectual property rights, and the expansion of financing channels specifically catered to SMEs. For instance, businesses pioneering advanced technologies are now positioned to access specialized funding programs designed to fuel their growth and market competitiveness. Moreover, the government’s recognition of SMEs as engines of innovation emphasizes the urgent need to foster an ecosystem that encourages collaboration, creativity, and resilience. Ultimately, this support aims to empower SMEs, enabling them to unlock their full potential and drive contributions to the national economy.

A Path Forward Amidst Challenges

Despite these proactive initiatives, many SMEs continue to face daunting challenges, particularly regarding financial accessibility. Traditional banks often prioritize lending to larger, state-owned enterprises, adhering to a risk-averse mentality that leaves SMEs scrambling for essential funding. For example, while recent capital market reforms offer a glimmer of hope, questions remain regarding how effectively smaller enterprises can leverage these new financial tools. Therefore, it is crucial for the government and industry leaders to work hand-in-hand, ensuring that these reforms translate into tangible support for SMEs. By fostering a supportive environment that recognizes the unique hurdles faced by small businesses, China can transform these challenges into opportunities for growth. In doing so, SMEs will not only become resilient players but also pivotal contributors to the country's broader economic recovery and innovation landscape, driving the nation forward.

Loading...