Understanding Bear Flag Patterns in Microsoft Shares

Overview

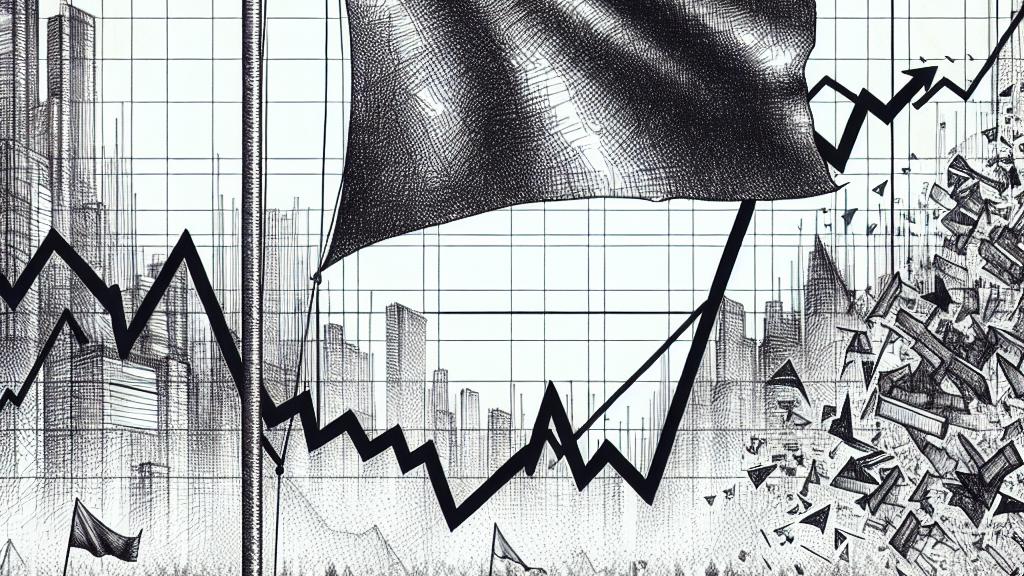

- Microsoft shares have recently surged, potentially forming a concerning 'bear flag' chart pattern that warrants attention.

- This bear flag pattern acts as an alert for investors, indicating a likely trend reversal that could impact trading strategies.

- By being vigilant and analyzing market patterns, traders can navigate potential downturns more effectively.

Detecting Bear Flags Amid Stock Movements

In the bustling financial markets of the United States, Microsoft shares have recently caught the spotlight. On September 19, opening at around $438.99, the stock's noteworthy rise was celebrated by many. Despite this positive momentum, analysts warn that these movements might be masking the formation of a 'bear flag' pattern, a crucial technical indicator that hints at possible downturns. Imagine a stock that spikes up only to transition into a narrow range, resembling a flag hanging limp in the wind; this is the essence of a bear flag. Such a pattern can signify a pause after a substantial drop, acting as a potential precursor to further declines. Therefore, what at first appears encouraging may instead be a signal for caution, prompting traders to think carefully before rushing into investments.

Deciphering the Impact of Bear Flag Patterns

A bear flag is more than just a chart pattern—it's an insight into the market's psychology! When formed, it usually indicates that traders could be preparing for another wave of selling pressure. For instance, consider if Microsoft shares were to breach the lower support line of this formation; this breach could unleash a torrent of selling that propels the stock price downward. This moment can mark a critical decision point for investors: should they hold on, sell, or perhaps even short the stock? Analyzing historical data reveals numerous instances where similar patterns have led to steep declines, reinforcing the importance of understanding the dynamics at play. Recognizing these signals isn't just smart—it's essential for navigating the complex trading environment.

Empowering Investors Through Strategic Analysis

Armed with knowledge of bear flag patterns, investors are better positioned to make strategic decisions amid market volatility. Recognizing these patterns allows traders to monitor potential pitfalls while also identifying lucrative opportunities. For instance, several famous traders reference technical signals and combine them with news events to form a full picture of the market environment. By doing so, they can anticipate shifts in stock behavior with a greater degree of accuracy. As traders focus on Microsoft’s movements and broader market influences, they stand to gain valuable insights. Ultimately, understanding chart patterns not only fosters confidence in trading decisions but also transforms uncertainties into structured action plans, crucial for thriving in the ever-changing landscape of stock markets.

Loading...