The Unseen Burden of Marketing on Youth

Overview

- In Japan, a shocking number of young individuals are unknowingly propelled into poverty through small, yet persistent expenditures driven by intense marketing strategies.

- The omnipresent nature of advertising, combined with social media pressures, compels young adults to engage in expensive consumer behavior that often spirals out of control.

- Economic hardships, particularly worsened by the COVID-19 pandemic, further complicate the financial challenges faced by today’s youth.

The Context of Youth Spending in Japan

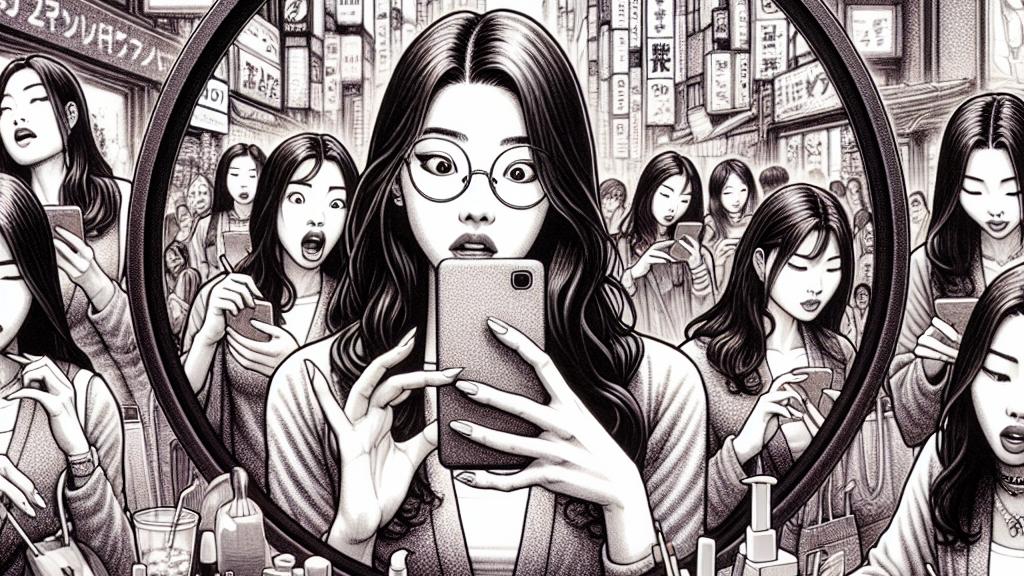

Imagine Tokyo's vibrant streets, bustling with youthful energy, where countless young people are caught in a trap of financial anxiety. For many young women, spending approximately 10,000 yen per month on beauty services—like manicures, haircuts, and cosmetics—has become a norm. They chase after the perfect look showcased on Instagram, believing that such appearances will lead to social acceptance and approval. A vivid example is a 23-year-old office worker who spends her entire paycheck on the latest beauty trends. She captures every new style in a selfie, only to later realize she has depleted her funds, leaving her struggling to pay rent at the month's end. This cycle is repeated endlessly, reflecting an alarming trend where individuals sacrifice financial stability for societal validation.

The Intrusive Role of Marketing in Shaping Consumer Behavior

The influence of marketing is pervasive and profoundly manipulative. Youth encounter advertisements everywhere: in the subway, on digital billboards, and overwhelmingly on social media. Take, for instance, a teenager who scrolls through countless posts flaunting luxurious lifestyles and trending outfits. This constant exposure creates a powerful urge to emulate those looks, often leading to unnecessary purchases. Here, the concept of FOMO (Fear of Missing Out) rears its head, capturing the imagination of young consumers. The emotional tactics employed by advertisers play on their insecurities, making them believe that happiness hinges on the next product they must have. Surprisingly, it is this very manipulation—rooted in comparison and emotional triggers—that leads many to overlook the adverse impacts on their financial health.

Economic Challenges and Their Profound Implications

The fallout from the COVID-19 pandemic has exacerbated existing financial insecurities among youth, making the scenario even more pressing. While surveys might paint a picture of overall life satisfaction, the reality is starkly different when considering financial security. Picture a recent graduate who struggles to make ends meet while also yearning for a lifestyle similar to what she sees online. She spends her evenings browsing shopping sites, desperately wanting what seems just out of reach. This tendency towards impulsive spending to alleviate the discomfort of her situation can lead to a vicious cycle of debt. To combat this, it is crucial to promote financial literacy among younger generations, enabling them to understand the value of money and the importance of making informed purchasing decisions. Ultimately, encouraging mindful consumption not only helps individuals avoid the pitfalls of marketing but also fosters a healthier mindset towards personal finance.

Loading...