Continued Rise of the Baht and Its Global Implications

Overview

- The baht has surged to a captivating 19-month high against the dollar, signaling Thailand's economic resilience and promise.

- Anticipated US interest rate cuts could dramatically elevate the baht's strength, making Thailand an attractive destination for investors.

- Simultaneously, the impressive rise in gold prices reveals the intricate connections between currency dynamics and global investment behaviors.

Strength of the Baht

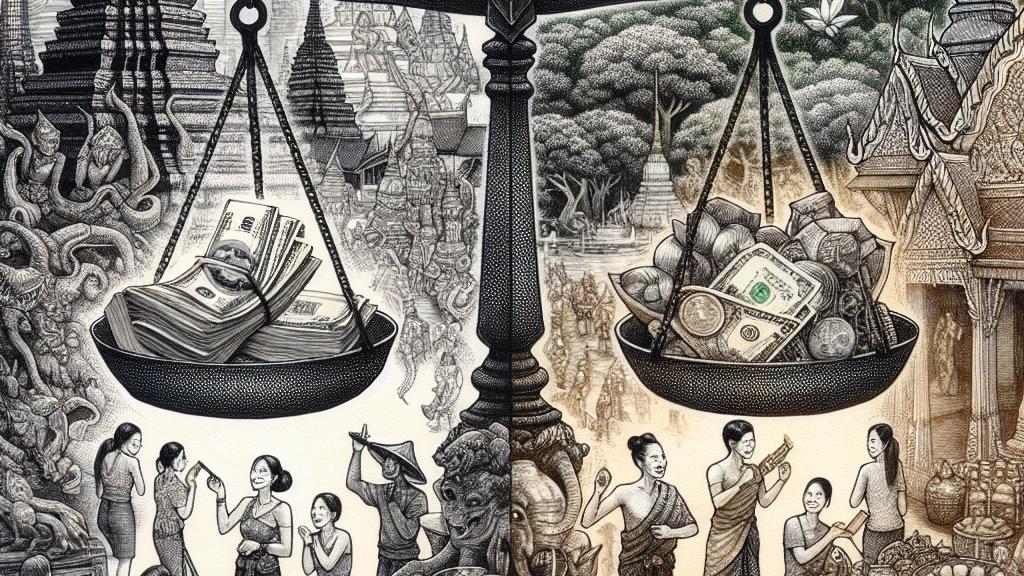

In an impressive turn of events, the Thai baht recently reached a striking 32.2 per US dollar, signifying an extraordinary rise that has not been seen in nearly 19 months. This isn’t merely a fluctuation; it represents a palpable confidence in Thailand’s economic trajectory amidst a world filled with uncertainties. Investors are increasingly eager to sell off US dollars, opting instead for the baht as their preferred currency. For example, many foreign investors have noted Thailand’s stable political climate and robust trade relations, solidifying their choice to invest. This growing strength of the baht not only opens doors for international trade but also enhances Thailand's allure for tourism, encouraging more visitors to explore its vibrant culture and natural beauty.

Influence of US Monetary Policy

As we look towards the future, the impending possibility of significant interest rate cuts by the US Federal Reserve promises to add more fuel to the baht's fire. Market predictions currently lean toward a remarkable 59% likelihood of the Fed implementing a substantial 50-basis-point cut at its next meeting. If this happens, it would be a groundbreaking moment—marking the Fed's first rate cut since 2020. Such a decision would weaken the dollar, consequently making Thai exports more competitive on global markets. Notably, in past economic shifts, lower US rates have often led to increased foreign investments in Asian markets, and Thailand is expected to be a leading beneficiary of this trend. If the Fed proceeds with this strategy, it could herald a new era of growth for Thailand’s economy, transforming it into a vibrant hub for business.

Global Effects and the Surge in Gold Prices

Amid these major economic developments, we cannot overlook the striking movements in the gold market, sharply influenced by the changing currency landscape. With the dollar experiencing a decline, gold prices have surged to remarkable heights, recently touching $2,589.23 per ounce. This increase illustrates a fascinating phenomenon: when currencies wobble, investors often flock to gold as a safe store of value. For instance, historical trends show that during economic uncertainty—like the aftermath of the 2008 financial crisis—gold prices frequently skyrocket due to heightened demand. This current situation is no different; it highlights how intertwined our global economy is, where currency value shifts can directly impact commodity prices. Understanding this correlation allows investors to strategize better, ensuring they remain one step ahead in navigating the complexities of the financial markets.

Loading...