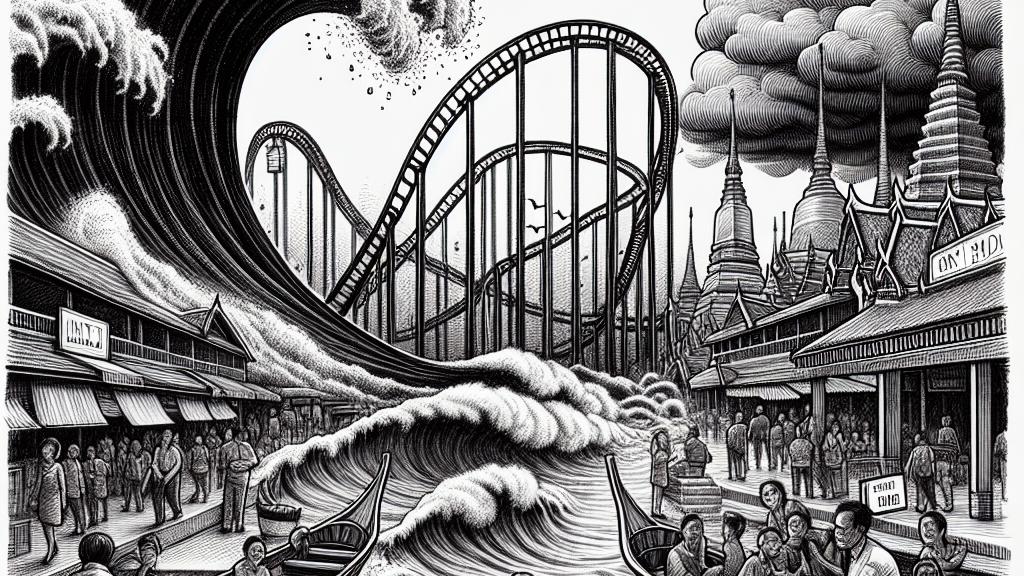

Baht on a Rollercoaster: Outpacing Regional Rivals against the Dollar!

Overview

- The baht displays remarkable volatility, eclipsing other Southeast Asian currencies.

- US economic policies loom large, influencing the future trajectory of the baht.

- Gold price increases intricately affect the baht's exchange dynamics.

Understanding Baht's Volatility

In the heart of Thailand, where bustling markets meet serene temples, the baht is on a remarkable rollercoaster ride. Currently, it boasts a year-to-date volatility of 7.3%, surprisingly outpacing the Korean won's 7.4% and asserting itself above regional currencies like the Malaysian ringgit and Indonesian rupiah—both resting at 5.5%. This turbulence can be likened to waves crashing against a shore, influenced by fears and anticipation regarding US Federal Reserve interest rate cuts and the insatiable thirst for gold imports. As traders speculate about these developments, the baht’s exchange rate dances between highs and lows, revealing the intertwined nature of global economics and local market sentiment.

Influence of Economic Factors

Delving deeper, we find that the baht’s fluctuations are propelled by powerful economic forces. For instance, recent figures from the US labor market revealed a modest increase of only 142,000 jobs—far from the anticipated 160,000. This shortfall sends ripples across the ocean of currency exchange, bolstering the dollar's position and, in turn, diminishing the baht’s stable footing. Moreover, with Thailand emerging as a heavyweight in the global gold market, the staggering 21% surge in gold prices this year elevates the stakes even further. Imagine the baht as a sailboat, navigating through choppy waters where every gust of wind in the form of international gold prices can either propel it forward or force it off course. Experts predict that the baht will oscillate predictably between 33.30 and 34 baht per dollar, reflecting a balance of both local and global economic tides.

Looking Ahead

As we set our sights on the horizon, the impending economic policy decisions from Thailand's new government loom large; these choices could prove pivotal in determining the currency's direction. Each policy could act as a lever, potentially moving the baht in one direction or another, much like the shifting gears of a finely tuned machine. Analysts are keen to point out that volatility will undoubtedly continue, fueled by the dynamic interplay between global gold prices and US economic indicators. For traders and investors, the key to success in this ever-evolving currency landscape lies in being adaptable and informed; much like skilled sailors who must read the winds and waves, ready to adjust their course as conditions change. In this intricate dance of currencies, the baht remains a compelling player on the global stage.

Loading...