Big Stock Stories That Could Shift the Market

Overview

- Major fluctuations in the stock market spotlight brands like Starbucks and McDonald's.

- Investors are intently watching rising Treasury yields in conjunction with key earnings reports.

- Market responses are volatile, shaped by crucial inflation updates and performance trends.

Market Movement in the U.S.

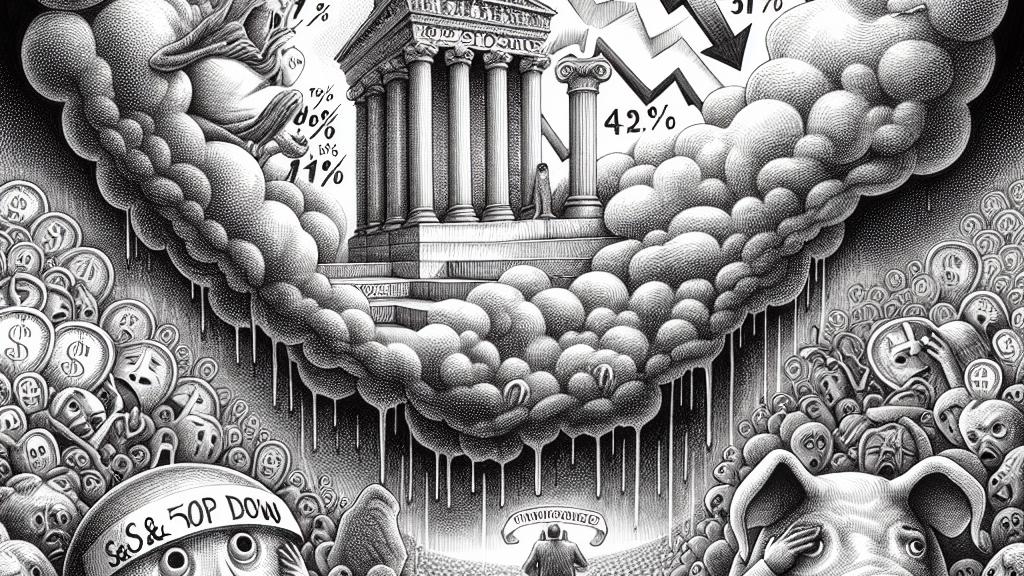

On October 22, 2024, the U.S. stock market faced intriguing dynamics. The Dow and S&P 500 witnessed declines for the second successive day, sparking concern among traders. A pivotal factor in this narrative was the 10-year Treasury yield, which climbed above 4.2%, becoming the center of attention and the most searched topic among investors. This rise in yields—an indicator of potential economic shifts—can greatly affect market sentiment, redefining investment strategies. Investors should stay alert; understanding the interplay between rising yields and stock prices is paramount to navigating this unpredictable landscape.

Company Performance: Starbucks and McDonald's

Starbucks is currently capturing significant attention as its stock price faltered by 4% after revealing preliminary quarterly results that alarmingly indicated a decline in same-store sales. Additionally, the company announced the suspension of its fiscal 2025 guidance, leading to increased uncertainty among investors about its future direction. In stark contrast, McDonald's shares dropped around 6% amidst troubling reports of 49 E. coli cases linked to their well-known Quarter Pounder burgers. This outbreak, reported across several states, starkly illustrates the rapid effects of health concerns on consumer trust and stock performance. Such vivid examples serve not only to highlight the volatility of the market but also to emphasize how external factors—especially related to food safety—can dramatically influence investor perceptions and market dynamics.

Earnings Season and Market Sentiment

With earnings season underway, the spotlight now shines on major companies like Coca-Cola, Tesla, and AT&T, whose upcoming reports could reshape market trajectories. Speculation abounds; if Coca-Cola announces robust earnings, it could inject much-needed optimism into the market, lifting investor spirits. Meanwhile, Tesla’s performance holds considerable weight, potentially impacting the entire tech sector. Moreover, the broader economic landscape, including ongoing inflation concerns, plays a crucial role in shaping market anticipation. As analysts await pivotal inflation data to drop, they underscore its potential to soothe or stir market emotions, making the next few days critical for investors seeking insights into their investment strategies going forward.

Loading...