The Costly Illusion: How I Burned 20 Million Yen in Day Trading!

Overview

- Engaging in day trading can lead to significant financial losses, especially when leveraging investments.

- Investing with a long-term perspective using spare funds has proven to be more reliable and stress-free.

- Understanding the complexities of the financial markets is vital for anyone looking to invest successfully.

The Current Landscape of Day Trading in Japan

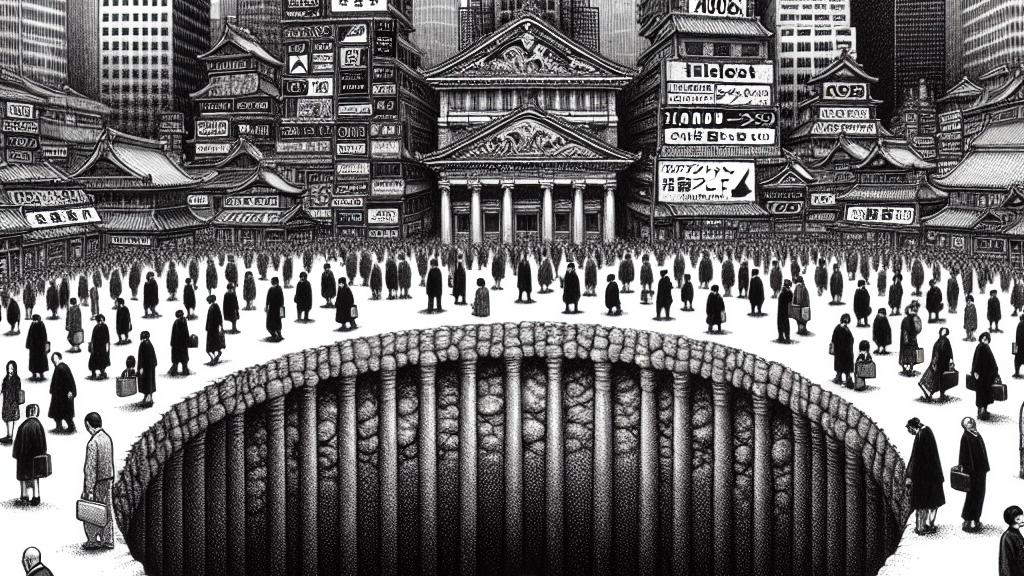

Japan is witnessing a vibrant investment climate, underscored by record highs in the stock market and government initiatives promoting investing, such as the expanded NISA program. This inviting environment has drawn many individuals into the realm of day trading, where they hope to achieve quick financial success. However, the story of a trader who lost over 20 million yen over six years serves as a chilling reminder of the potential pitfalls involved. This narrative illustrates that the promise of rapid gains can often conceal the harsh realities of market volatility and risk, highlighting the caution needed when diving into day trading.

The Illusion of Control: Risks of Day Trading

Day trading can create an illusion of control and profitability, particularly for those with a strong belief in their analytical abilities. Many traders, even those with exceptional academic credentials, enter the market with confidence, only to find themselves outmatched by the realities of trading. The competitive nature of financial markets, combined with sophisticated trading algorithms, means that amateur traders frequently encounter losses. The core message conveyed is clear: day trading is often akin to gambling, where the house—a combination of market forces and institutional investors—tends to win. Therefore, it is prudent to approach trading with a mindset geared towards long-term investment rather than the lure of quick profits.

Embracing Sustainable Investment Strategies

Learning from the adverse experiences in day trading, investors are encouraged to adopt a long-term perspective focused on sustainable wealth accumulation. Strategies that emphasize diversified portfolios and index funds often yield steadier returns with significantly lower risk compared to day trading. Such approaches not only mitigate the anxiety associated with market fluctuations but also allow investors to benefit from the natural appreciation of their assets over time. Understanding that investing is a long-term endeavor fosters a healthier relationship with money, encouraging practices that build financial security rather than lead to speculation and disappointment. Ultimately, the goal is to empower individuals with the knowledge that facilitates informed investment decisions, ensuring their time and financial resources are used wisely.

Loading...