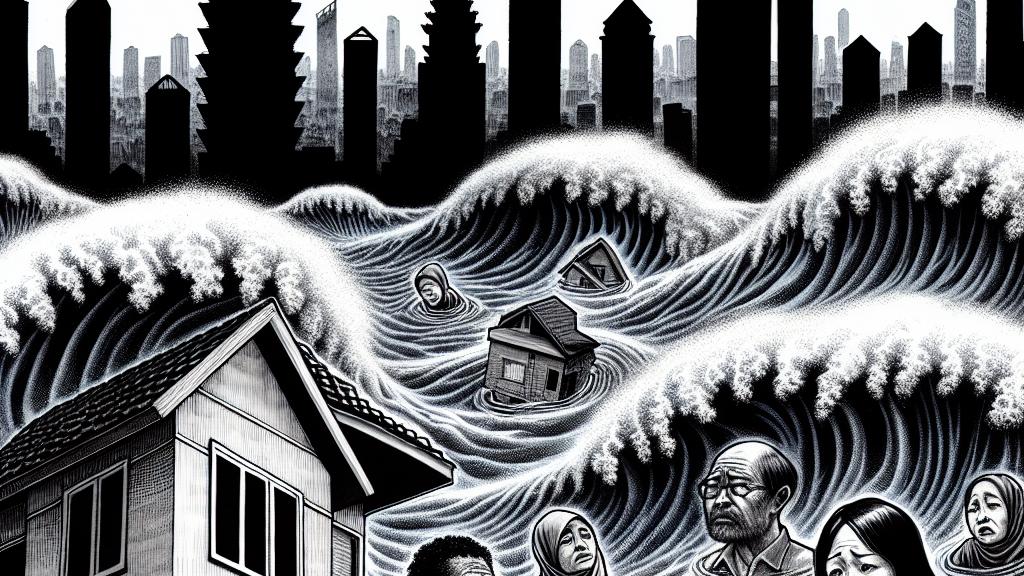

Bangkok's Mortgage Crisis: The Rising Tide of Bad Debt

Overview

- Rising mortgage bad-debt rates in Thailand signal economic distress.

- Lower-income homeowners struggle as interest rates climb.

- Shift in bank lending focus towards higher-income borrowers exacerbates crisis.

The Alarming Surge in Bad Debt in Bangkok

In Bangkok, Thailand's vibrant capital, the mortgage sector is grappling with a significant rise in bad-debt rates, now reported at 3.7% of outstanding mortgage credit. This increase predominantly affects lower-income homeowners, who often earn less than 30,000 baht monthly. The challenges began when many borrowers transitioned from fixed-rate mortgages to floating rates, leading to higher monthly payments that are increasingly difficult to manage amid stagnant wages. Many of these homeowners have yet to see their incomes recover to pre-pandemic levels, heightening their financial vulnerability. This critical situation threatens not only individual families but also the broader housing market, which has been historically anchored by home ownership and mortgage lending.

Understanding the Broader Impact of Non-Performing Loans

The implications of rising non-performing loans (NPLs) are evident across various segments of the lending landscape, with the NPL ratio for all consumer loans climbing to 3.13%. This uptick reflects a worrying trend in the banking sector, where financial institutions are facing increasing pressure as the overall NPL ratio rises to 2.84%. Small and medium-sized enterprises are particularly hard hit, with NPLs reaching 6.89%. As banks reassess their risk profiles, they are tightening lending criteria and increasingly focusing on higher-income borrowers. This trend is creating a gap in financial access for lower-income families, leaving them vulnerable and potentially leading to a cyclical pattern of debt default and economic hardship.

Charting a Course Towards Economic Recovery

Despite these stark challenges, there are emerging signs of potential recovery within Bangkok's mortgage market. The Bank of Thailand has indicated an uptick in mortgage approval rates, suggesting a glimmer of hope for some borrowers. Furthermore, policymakers are considering measures to support financially distressed homeowners, particularly those facing crises due to natural disasters like floods. These initiatives reflect a dedication to responsible lending practices in a time of heightened economic uncertainty. However, the path forward will require collaboration between financial institutions and regulatory bodies to forge a balanced approach that not only promotes fiscal responsibility but also safeguards the financial well-being of lower-income homebuyers. A concerted effort is essential to navigate this complex landscape and ultimately foster a more resilient housing market in Thailand.

Loading...