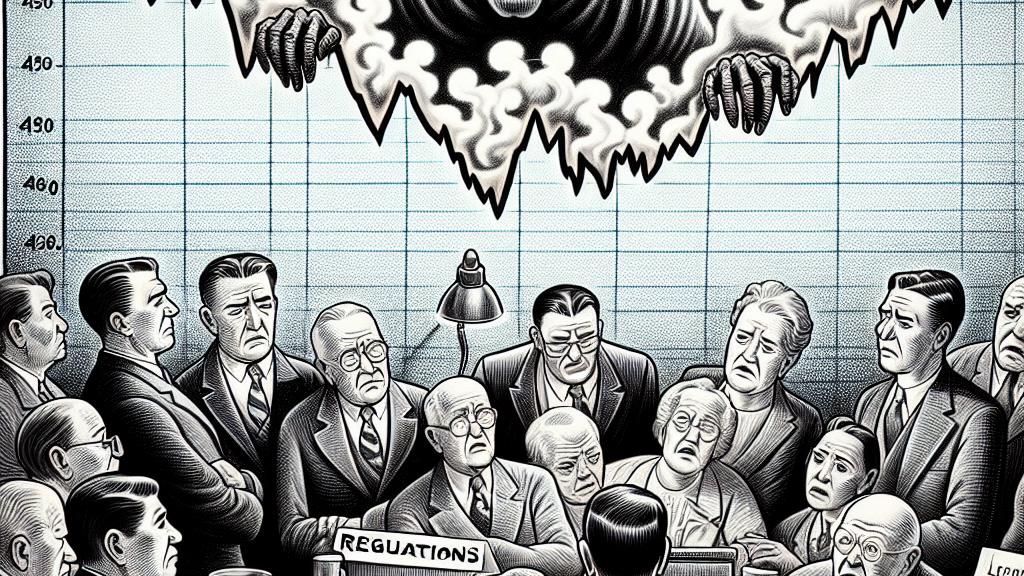

Investors Anxious as Food Stocks Plummet Amid RFK Jr. Scrutiny

Overview

- Food stocks are plummeting as scrutiny intensifies with RFK Jr.'s appointment.

- Kennedy's vision for the FDA could significantly alter food regulations.

- Investor anxiety about potential health policy shifts is rising dramatically.

The Context of the Decline

In recent weeks, the food industry in the United States has been rocked by significant turmoil. The announcement of Robert F. Kennedy Jr. as President-elect Donald Trump’s choice for Secretary of Health and Human Services sent shockwaves through the stock market, leading to a rapid decline in major processed food stocks. For instance, renowned companies like PepsiCo and General Mills experienced losses of over 3%, igniting fears among investors. This investor apprehension isn’t unfounded; it stems from the potential upheaval of the Food and Drug Administration (FDA). The thought of a regulatory overhaul raises alarms about stricter controls that could reshape food production, marketing strategies, and consumer choices across the board, impacting cherished brands that might face new restrictions.

Kennedy's Potential Regulatory Overhaul

Kennedy’s mission to reform the FDA is both ambitious and controversial. He has promised to dismantle what he deems a corrupt agency that prioritizes the interests of ‘Big Pharma’ and ‘Big Food’. His strong emphasis on increasing transparency regarding food safety and labeling practices resonates with a public increasingly concerned about what they consume. He notably criticized the gross discrepancies in food ingredients between the U.S. and countries like Canada, using examples like Fruit Loops. While Canadian versions contain fewer ingredients, U.S. formulations often have long, complex labels packed with additives, which raises red flags for health-conscious consumers. With Kennedy potentially wielding significant power over these regulations, investors of iconic brands, such as Kraft Heinz and Campbell Soup, face mounting uncertainty that could adversely affect profit margins and market dynamics.

Investor Sentiments Amidst Looming Changes

Amidst this anxiety, there’s a curious undercurrent of cautious optimism among investors. Recent surveys reveal that, despite worries about inflation and fluctuating markets, many remain steadfastly loyal to established brands they trust. This loyalty shines through, particularly when considering the solid reputation of companies that have weathered previous storms. The looming question is this: will Kennedy’s proposed changes lead to healthier products and better consumer safety, or will they stifle the availability of popular packaged goods? The potential for a seismic shift in food regulation tantalizes many, suggesting that while risks are high, opportunities for growth and innovation may also arise. In conclusion, as the industry braces for potential upheavals, the resilience and adaptability of leading food brands could ultimately reassure investors in these unpredictable times.

Loading...