License to Steal: Unraveling the New Credit Card Fraud Scheme!

Overview

- Police arrest a group involved in creating fake driver's licenses, exposing severe security flaws.

- Fraudsters manipulated stolen ID information for illicit credit card applications, evading detection.

- The incident highlights significant risks associated with sharing personal IDs and calls for robust authentication improvements.

The Incident in Japan

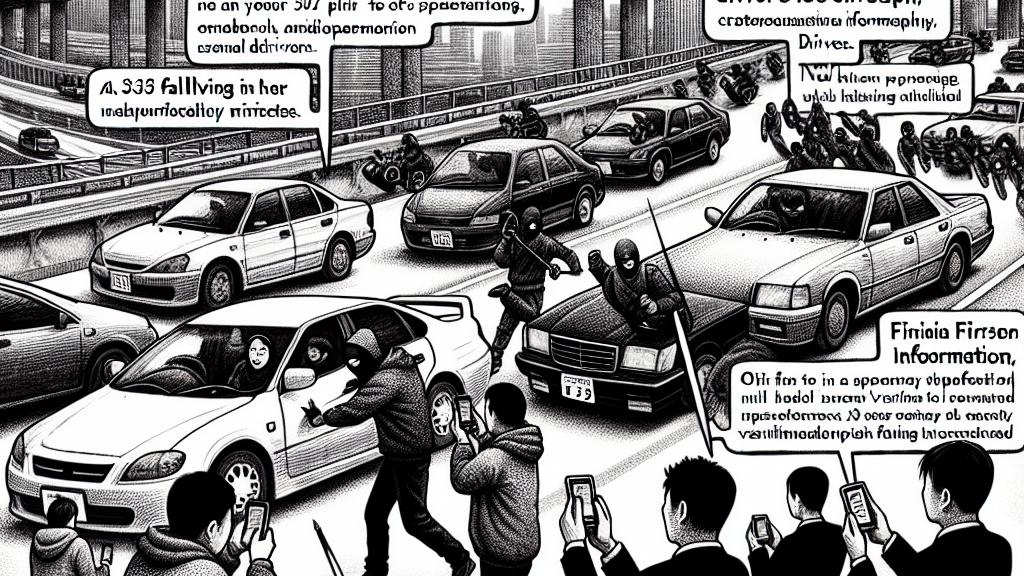

In Japan, a concerning case has emerged involving the arrest of three individuals in their 30s for allegedly creating counterfeit driver's licenses to fraudulently acquire credit cards. The Tokyo Metropolitan Police discovered that the suspects targeted drivers on highways, utilizing aggressive tactics to make unwarranted demands for driver's licenses. This scheme saw them photographing personal information from these IDs, enabling them to forge convincing replicas. This alarming occurrence not only draws attention to the blatant disregard for privacy but also reveals significant gaps in security protocols, as financial institutions surprisingly failed to identify these counterfeit IDs during their verification processes, resulting in unauthorized access to credit.

Mechanics of the Fraud Scheme

The mechanics of this fraud scheme expose an unsettling trend in data security vulnerabilities. After obtaining stolen driver's license information, the criminals impersonated their victims for online financial transactions, successfully bypassing standard security measures that most financial institutions have in place. This method reveals a pressing issue regarding identity theft, particularly as our world becomes increasingly digitized. It indicates a need for banks and financial organizations to strengthen their verification systems, incorporating advanced technologies such as biometric recognition and artificial intelligence algorithms to detect fraudulent claims more effectively. Institutions must prioritize investment in cybersecurity to prevent future incidents and protect consumer interests.

The Rise of Phishing Scams

In conjunction with identity theft, the prevalence of phishing scams has skyrocketed, with criminals impersonating legitimate financial entities to manipulate consumers into divulging sensitive information. These scams often utilize psychological tactics, creating a false sense of urgency to instill fear among potential victims. The surge in online shopping due to the COVID-19 pandemic has further accelerated the opportunities for such scams to thrive. Individuals need to remain vigilant and adopt protective measures, such as scrutinizing email communications and avoiding the clicking of unfamiliar links. Comprehensive consumer education regarding these fraudulent techniques is vital to empowering individuals in safeguarding their financial information and assets against worsening threats.

Loading...