U.S. Credit Rating at Risk Amid Growing Fiscal Challenges

Overview

- Moody's Ratings has issued a stark alert about the potential downgrading of the U.S. credit rating, spurred by mounting budget deficits.

- The outcome of upcoming negotiations on tax policies and fiscal reforms could be pivotal for maintaining economic stability and creditworthiness.

- Lessons learned from past financial crises remain relevant, continuously shaping today's fiscal decisions.

The Fiscal Health of the United States

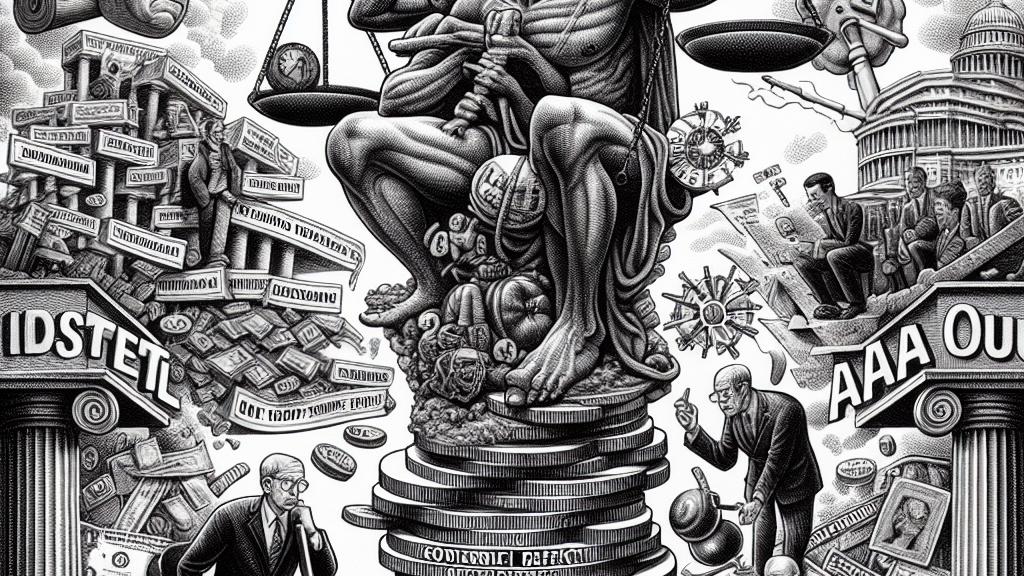

The United States is at a crucial turning point, facing alarming fiscal challenges that threaten to undermine its coveted AAA credit rating. Moody's Ratings, in a compelling warning, has highlighted the risks presented by steadily rising budget deficits. Unlike its counterparts, Moody's has remained steadfast in holding onto this top rating, even though Fitch and S&P Global Ratings have downgraded U.S. credit in recent years. This situation poses a critical dilemma: without swift and decisive policy changes, the nation’s financial reputation could slip away faster than one might expect. Heightened borrowing costs could emerge as a result, affecting everything from governmental projects to student loans and even business investments.

Implications of Political Decisions

In this overarching narrative, the political dynamics surrounding the extension of the Tax Cuts and Jobs Act (TCJA) will take center stage. This momentous decision is not merely political; it has real economic consequences. If Congress can unite, it might just produce the necessary bipartisan support to pave the way for substantial fiscal reforms. However, if disputes continue to fester, the potential for serious fiscal missteps looms large. Interest rates will certainly play a role, too. Low rates could ease debt burdens, while any increase might exacerbate the financial strain. Therefore, the stakes are incredibly high, as the choices made in the coming months could either stabilize the economy or push it into turmoil.

Learning from Past Fiscal Responses

Looking back at the fiscal strategies deployed during the COVID-19 pandemic provides essential insights for today's decision-makers. The U.S. government injected a jaw-dropping $5.2 trillion into recovery efforts, which, while necessary, sparked significant debates about future fiscal responsibility. For instance, direct payments to citizens were helpful—but many recipients were not in need. Meanwhile, the Paycheck Protection Program, although noble in its intention, ended up costing taxpayers dearly for each job saved. As the troubling prospect of a soaring debt-to-GDP ratio approaches, the importance of learning from these past measures cannot be overstated. A balanced approach—one that considers immediate needs while securing long-term fiscal health—will be vital to navigating the complexities of today's economic landscape. Fostering resilience and adaptability in policy-making could very well determine the country's financial fate.

Loading...