Tuna Trouble: Manuel Chang’s Corruption Case Shakes Mozambique!

Overview

- Former Mozambique finance minister Manuel Chang convicted in a landmark corruption case.

- The 'tuna bond' scandal involved $2 billion in fraudulent loans linked to non-existent maritime projects.

- The economic repercussions have left millions in poverty and destabilized Mozambique's financial landscape.

Corruption Unveiled

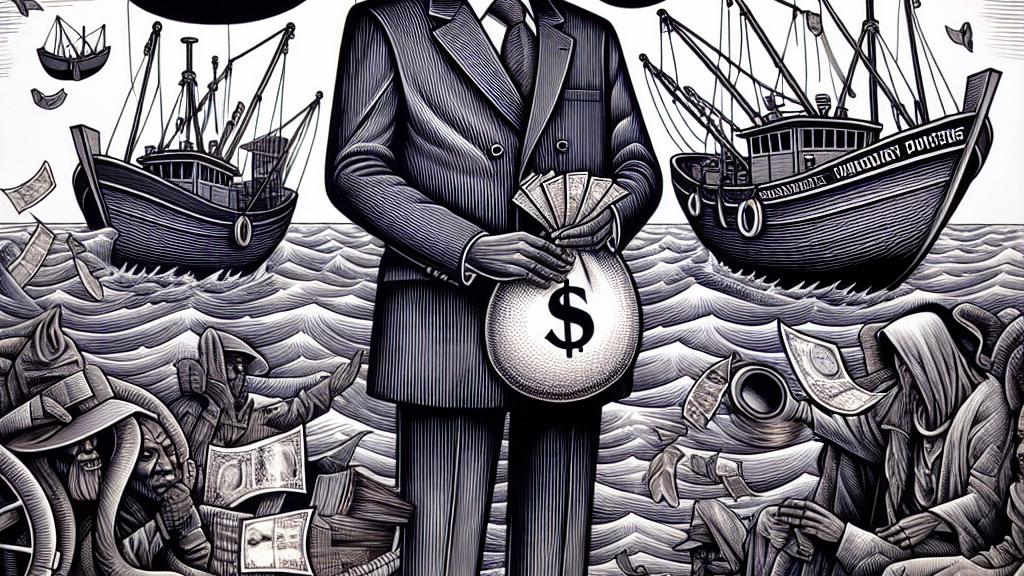

The case of Manuel Chang, Mozambique's former finance minister, brings to light a shocking chapter in the country's history of corruption. Convicted for orchestrating a $2 billion conspiracy under the guise of creating government-funded tuna fishing operations, Chang's actions have been characterized as one of Africa’s largest corruption scandals. Between 2005 and 2015, he approved hidden loans intended for fishing vessels that were never delivered, while lining his pockets with roughly $7 million in bribes from the shipbuilding firm Privinvest. This scenario showcases how the intersection of power and greed can lead to a systemic failure in governance.

Economic Impact

The fallout from the 'tuna bond' scandal has drastically affected Mozambique's economy. The fraudulent loans became part of a hidden debt crisis, prompting the International Monetary Fund (IMF) to withdraw its support. This withdrawal exacerbated an already struggling economy and is believed to have pushed over two million Mozambicans into poverty. Analysts indicate that the loss of funds resulted in significant cuts to public services and infrastructure development, delaying the nation’s growth and compromising its financial stability. The ramifications highlight the detrimental effects corruption can have on a nation’s public well-being and future.

Justice and Accountability

Chang's conviction in a U.S. court represents a pivotal moment in the fight against corruption, illustrating a growing global commitment to prosecuting financial misconduct among high-ranking officials. Despite his claims of innocence and intention to appeal, the case emphasizes the importance of accountability in governance and encourages scrutiny of corrupt practices. It sends a message to both the people of Mozambique and international observers that justice can prevail, fostering hopes for reform and increased transparency in governmental operations. The trial has rekindled discussions on promoting ethical standards and combating corruption across Africa, serving as both a warning and a beacon for the future.

Loading...