Wall Street Analysts Favor These Dividend Stocks

Overview

- Top analysts pinpoint high-yield dividend stocks as excellent income sources.

- Financially sound companies with robust growth potential stand out.

- Exciting investment opportunities lie within the energy and technology sectors.

Key Dividend Stocks in Focus

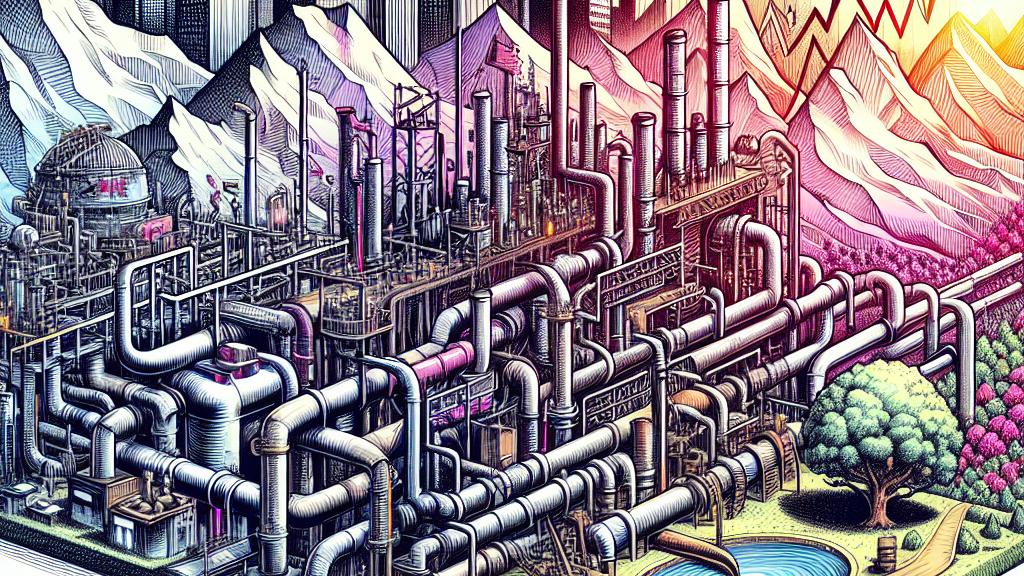

In the dynamic financial landscape of the United States, Wall Street analysts are directing attention towards several dividend stocks that are well worth considering. For starters, Energy Transfer (ET) emerges as a significant player in the midstream energy sector, flaunting an impressive dividend yield of 7.8%. This extensive company operates over 130,000 miles of pipelines across 44 states, presenting a robust foundation for consistent cash flow. Notably, analysts from RBC Capital highlight Energy Transfer’s strategic positioning in the Permian Basin and its recent acquisition, which are seen as catalysts for future growth. Consequently, this makes Energy Transfer a highly attractive option for investors who prioritize stable, recurring income while also seeking growth opportunities.

Positive Outlook for Diamondback Energy

Turning our focus to Diamondback Energy (FANG), this independent oil and natural gas company stands out for its resolute commitment to shareholders. The recent announcements of a base cash dividend of 90 cents per share, alongside a variable dividend of $1.44, showcase their resolve to provide value to investors. Acclaimed analysts like Arun Jayaram from JPMorgan illustrate confidence in Diamondback’s operations, particularly in the wake of its Endeavor Energy acquisition, suggesting that this merger will facilitate substantial operational synergies. Moreover, Diamondback’s strategy, focusing on achieving flat to low-single-digit volume growth while maximizing efficiency, positions it favorably in the competitive Midland Basin. Thus, for those seeking dependable dividends paired with potential capital gains, Diamondback Energy undeniably deserves a place on your watchlist.

Cisco's Transition to Tech Dividends

Finally, we must not overlook Cisco Systems (CSCO), a stalwart in networking that is embracing innovation while maintaining its commitment to dividends. With a dividend yield of 2.9%, Cisco’s ongoing transition towards smart, AI-powered networks represents a strategic pivot that could yield substantial returns. Analysts from Tigress Financial have not only raised their price target for Cisco in recognition of this positive trajectory but have also underscored the growing demand for sophisticated cybersecurity solutions amidst rising enterprise investments. As Cisco leads in technological advancements while ensuring strong financial results, it captures the interest of investors who seek a fruitful blend of consistent income and promising growth prospects. Thus, investing in Cisco emerges as a savvy choice for those wishing to diversify into the tech sector while enjoying steady dividends.

Loading...