Expert Picks: Top Stocks with Promising Futures

Overview

- Discover lucrative investment opportunities in today's dynamic stock market.

- Top Wall Street analysts showcase stocks with solid fundamentals and innovative strategies.

- Adopt a long-term growth mindset to thrive amidst economic fluctuations.

Market Context

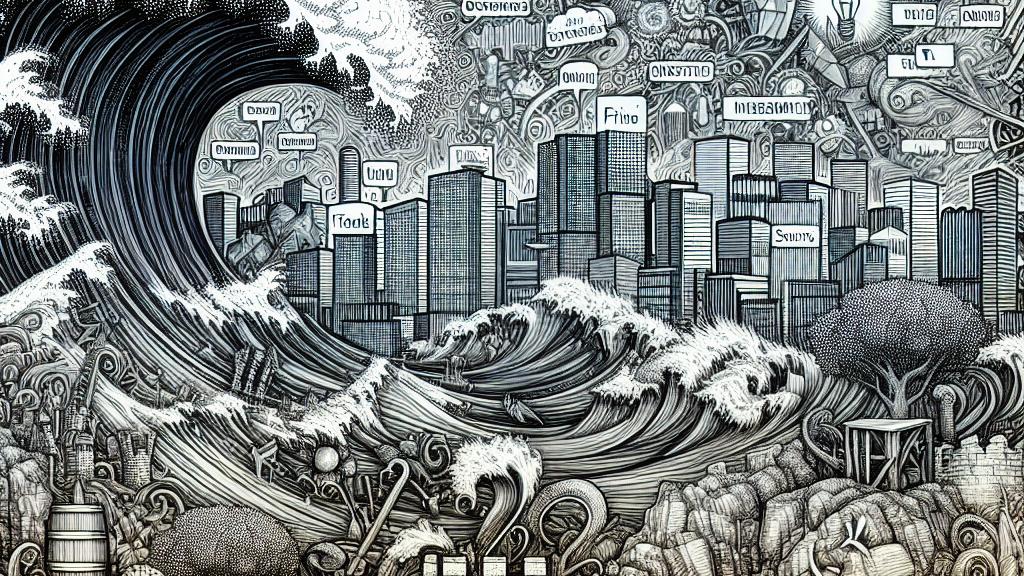

The U.S. stock market is currently experiencing a turbulent phase, driven by macroeconomic uncertainties and potential policy shifts under President-elect Donald Trump. This environment, while intimidating to some, actually opens up a treasure trove of investment opportunities. Investors who can look beyond momentary fluctuations are likely to discover companies equipped to adapt and flourish, despite the storms. Resiliency is key; thus, focusing on firms with strong financials, innovative products, and reliable business models not only serves as a strategy for navigating this chaos but also opens doors to meaningful long-term gains.

Highlighted Stocks

Three stocks that have gained traction and are making waves in this potent market landscape are ServiceNow, Snowflake, and Twilio. Take ServiceNow, for example—it’s not just any software company; it specializes in AI-driven workflow automation tools that recently posted third-quarter results outperforming market expectations. Analysts are buzzing about its new Workflow Data Fabric product, positioning ServiceNow to potentially double its addressable market—a move that could be monumental. Then there's Snowflake, the superstar of data analytics, whose stock surged nearly 33% after unveiling an impressive earnings report. This company has skillfully navigated storage challenges and signed multiple multi-million dollar contracts, showcasing a sustainable growth strategy. Lastly, Twilio, a recognized leader in cloud communications, has turned around its fortunes impressively. After a phase of slow revenue growth, Twilio has not only reassured investors by exceeding expectations in its latest quarter but also by upgrading its full-year revenue forecast, highlighting its pivotal role in a rapidly digitalizing world. Together, these exceptional companies exemplify adaptability and innovation, making them a focal point for savvy investors.

Analysts' Insights

The perspectives of top analysts are invaluable, acting as a guiding light in a sea of uncertainties. With their deep analysis and market expertise, these professionals assess each company’s performance, modifying price targets and recommendations in line with the latest data and trends. Analysts are particularly optimistic about companies like ServiceNow and Twilio, emphasizing their strategic advancements and robust market positioning. For instance, they note the importance of focusing on innovative firms that are not just surviving but thriving, as these are set to deliver impressive returns in an evolving landscape. By spotlighting stocks that hold long-term promise, analysts enable investors to be strategic, encouraging patience in a market often swayed by momentary events. The call to action for investors is clear: keeping an eye on groundbreaking companies with visionary leadership and forward-thinking strategies is key to capitalizing on future growth.

Loading...