Understanding the System Problems at Mitsubishi UFJ Bank

Overview

- A significant system outage disrupted ATM and online banking services for many customers.

- The underlying cause was a memory shortage stemming from inadequate database updates.

- This incident starkly underscores the essential need for meticulous IT management within the banking sector.

What Happened?

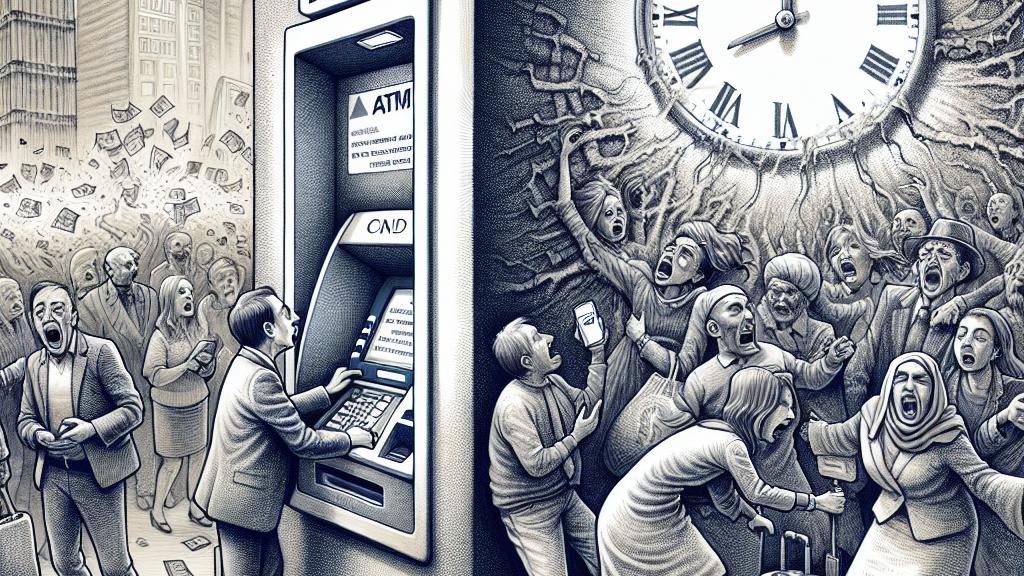

On January 9, 2025, Mitsubishi UFJ Bank, a cornerstone of Japan's banking industry, encountered a serious system failure. Imagine the scenario: you walk to an ATM to withdraw cash, only to face the frustration of seeing an error message instead. That day, a multitude of customers experienced this very disappointment, as both cash withdrawal functionality and online banking services went down. This unexpected disruption caused chaos, leaving clients unable to access their funds, pay bills, or handle finances. Hours felt like an eternity to users who relied heavily on these services for their daily transactions. Thankfully, the bank managed to restore services by the following morning, but the entire experience highlighted a critical weakness in their system.

Why Did It Happen?

Upon investigation, the cause of this meltdown was traced back to an oversight during a routine database update. The IT team set out to modernize and improve their systems, believing they would enhance customer experience. However, during this upgrade, the addition of a new database was mishandled, as sufficient memory was not allocated to support the additional data requirements. To put it simply, it was like trying to pour a gallon of water into a pint-sized container—inevitably, it was going to overflow! This miscalculation led to a server overload, sparking the widespread outages that ensued. Such scenarios serve as poignant reminders that thorough testing and careful planning are non-negotiable when it comes to changes in banking IT systems.

Lessons Learned

This incident offers invaluable lessons not only to Mitsubishi UFJ Bank but to the entire banking sector. Customer trust is paramount; without it, a bank's reputation can suffer irreparable damage. For a bank, losing the ability to conduct transactions, especially during peak periods like holidays or weekends, is detrimental. Customers expect seamless services; anything less can lead to frustration and dissatisfaction. Going forward, Mitsubishi UFJ should prioritize transparent communication—they must keep their clients informed about system changes and potential impacts. Additionally, investing in more robust testing protocols would help ensure smooth transitions during upgrades. The digital age demands that banks remain agile and responsive; maintaining high levels of trust and satisfaction is essential for staying competitive in a rapidly evolving landscape.

Loading...