Indonesian Crypto Exchange Indodax Reports Alleged Hack and Assures Fund Safety

Overview

- Indodax, a major cryptocurrency exchange in Indonesia, suffers an alleged $22 million hack, raising eyebrows across the industry.

- Despite this alarming breach, the company assures users that their crypto assets are perfectly safe.

- The exchange has halted operations temporarily to conduct urgent investigations and strengthen its security safeguards.

A Shocking Breach Shakes the Crypto Community

In a startling announcement, Indodax revealed that it had fallen victim to an alleged hacking incident, which may have resulted in the staggering loss of around $22 million. Such a significant figure paints a grim picture for the Indonesian cryptocurrency market. In their response, Indodax cited a 'potential security issue' that led to the suspension of all trading activities. However, in a bid to quell rising fears, the exchange reassured users that their balances—comprising various cryptocurrencies and Indonesian rupiah—were completely secure and unharmed during this unsettling time. Nonetheless, this incident highlights a pressing issue: leading blockchain security experts suggest that the stolen assets included valuable cryptocurrencies like Bitcoin, Ether, and Shiba Inu.

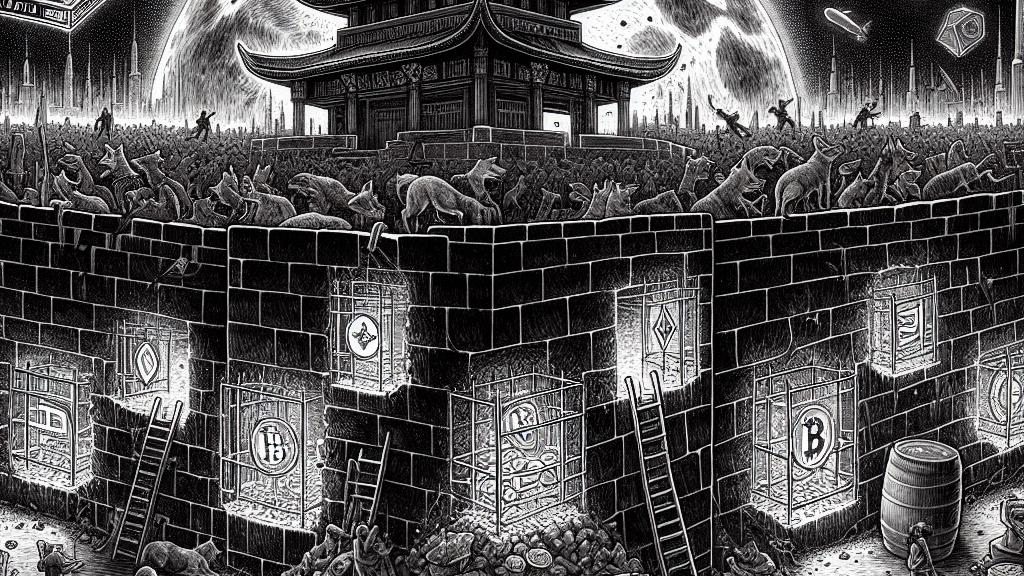

Hot Wallet Vulnerabilities: A Hacker's Playground

The hackers specifically targeted Indodax's hot wallets, digital wallets that are constantly connected to the internet and thus susceptible to breaches. This strategic choice allowed them to execute over 150 suspicious transactions seamlessly, with funds being swiftly converted into Ethereum, a common tactic employed to obscure the origins of stolen assets. Adding to the gravity of the situation is the speculation that points towards the notorious Lazarus Group, a North Korean hacking syndicate well-known for its audacious assaults on crypto exchanges globally. This connection not only amplifies fears about the inadequacy of existing security measures but also compels urgent discussions about the necessity of robust regulations within the cryptocurrency sphere, especially in regions that are still navigating the complexities of digital asset governance.

The Broader Implications and a Call for Enhanced Security

The incident at Indodax serves as a glaring reminder of the vulnerabilities present in the cryptocurrency landscape, where hackers eagerly exploit lapses in security protocols. While Indodax is actively working to fortify its defenses through comprehensive maintenance and detailed investigations, the pervasive anxiety surrounding asset losses continues to haunt investors. This unease underscores the demand for tighter regulatory frameworks across the industry. Analysts emphasize that without rigorous security measures and clear legal guidelines, users will remain at the mercy of cybercriminals who prey on the unprotected. Consequently, in areas lacking effective legal recourse, victims of such breaches often find themselves overwhelmed, grappling with feelings of frustration as they search for practical avenues for recovery.

Loading...