Impact of Labour's Capital Gains Tax Increase on UK Entrepreneurs

Overview

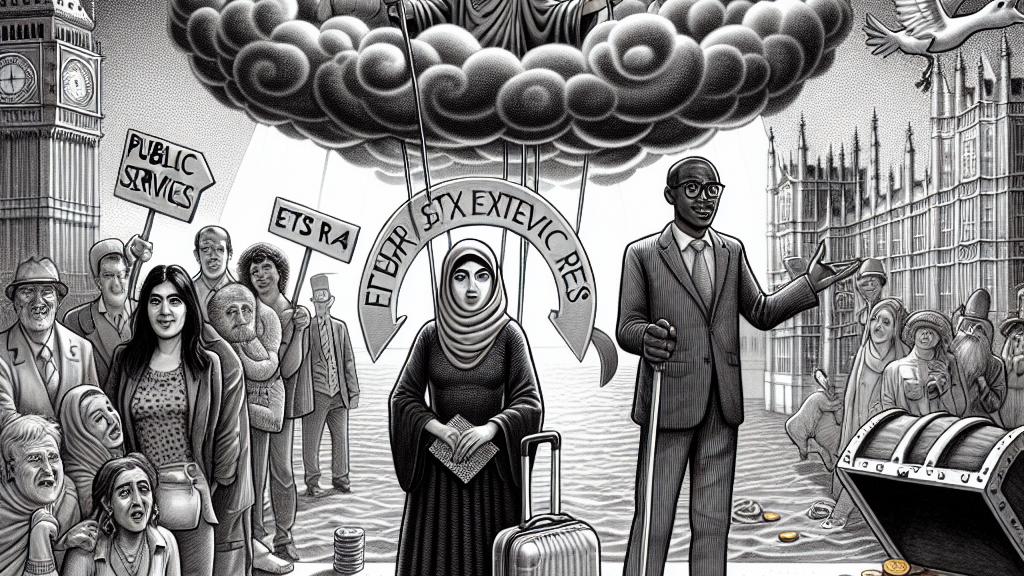

- Labour's budget proposes substantial capital gains tax hikes aimed at strengthening public services.

- Tech founders feel relieved as the rate increases are milder than previously expected.

- Ongoing fears about potential brain drain persist among the entrepreneurial community regarding tax changes.

A Landmark Budget Announcement

In what can be described as a transformative moment for the UK economy, Finance Minister Rachel Reeves presented a budget that raises capital gains tax (CGT) rates on investment profits. Specifically, the lower CGT rate will surge from 10% to an impressive 18%, while the higher rate will leap from 20% to a staggering 24%. This comprehensive move is anticipated to raise an additional £2.5 billion for public services, which is crucial for addressing the country's funding challenges. While entrepreneurs braced themselves for a potential tax storm, fearing a mass migration of talent and investment to countries with more business-friendly tax policies, the less severe reality offered a welcome sigh of relief within the tech community.

Mixed Reactions from Entrepreneurs

Responses from the tech sector have been a kaleidoscope of emotions—ranging from trepidation to cautious positivity. Many founders initially worried about the impending tax changes and the threat of a 'brain drain,' where UK talent might relocate to nations like the U.S. in search of lower taxes. However, following the budget announcement, some tech leaders remarked that the actual changes were not as daunting as they had imagined. For instance, the decision to preserve the £1 million lifetime capital gains exemption under the business asset disposal relief (BADR) scheme mitigated fears and created a glimmer of hope that entrepreneurial ventures could continue to flourish despite heightened tax burdens.

Navigating Future Challenges

Yet, even amidst this cautious optimism, significant hurdles loom on the horizon for UK entrepreneurs. Particularly troubling is the concurrent hike in National Insurance contributions for employers, increasing from 13.8% to 15%, which could strain operational budgets. Furthermore, a recent survey revealed a staggering 89% of tech founders are considering relocating their businesses abroad if capital gains tax rates spike further. As the UK navigates the complex terrain of public finance reform and economic recovery, the ability of entrepreneurs to adapt and thrive in this shifting landscape will be vital. Engaging with these challenges proactively, while leveraging the opportunities created by ongoing innovation, is essential for the future of entrepreneurship in the UK.

Loading...