Market Movements: Key Stock Stories for Tuesday

Overview

- PepsiCo and Boeing are key players that will shape market trends this week.

- Insurance stocks are facing sharp declines as Hurricane Milton approaches.

- Rising Treasury yields are stirring up conversations in the bond market.

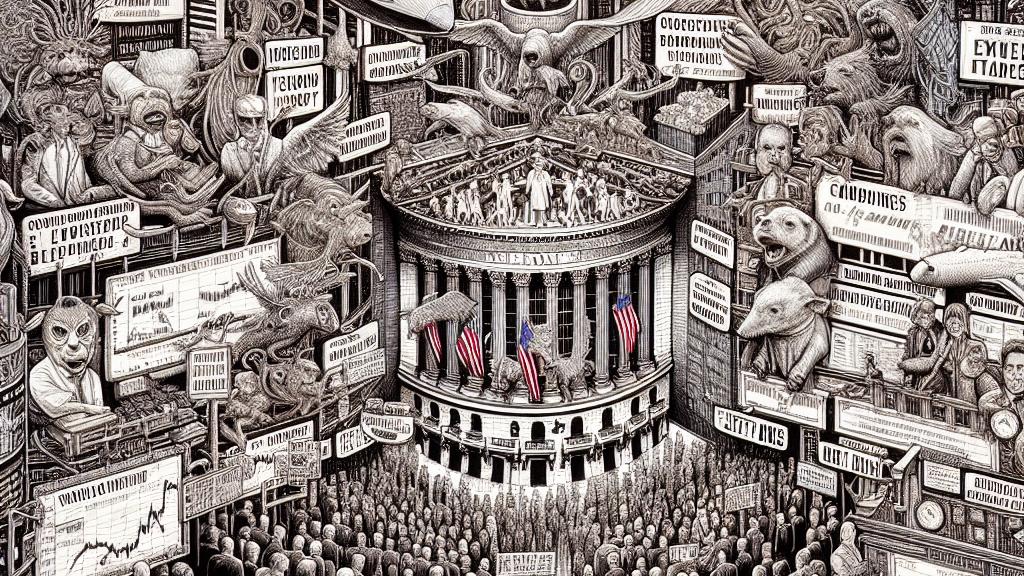

Market Overview: Anticipating Key Announcements

In the vibrant trading environment of the United States, the stock market is buzzing with activity, driven by significant events slated for this week. Investors are on high alert as they await reports from industry giants like PepsiCo, famed for its beloved snacks and beverages, which will soon announce its quarterly earnings. This report could reveal new insights into consumer trends and corporate resilience amidst fierce market competition. Meanwhile, Boeing, the aerospace heavyweight, is set to disclose its September jet orders. Given the soaring demand for air travel, especially post-pandemic, the outcomes of these announcements could dramatically influence investor sentiment and stock trajectories, underscoring the interconnected nature of financial markets.

Hurricane Milton's Impact on Insurance Stocks

As Hurricane Milton—a devastating Category 5 storm—draws closer to Florida, the insurance sector is bracing for impact. The looming threat has already sent stocks tumbling, with Travelers witnessing a notable 4.3% dip in its shares, marking a 7% decline from its recent highs. Other companies, like Progressive and W.R. Berkley, have similarly faced sharp price drops that reflect widespread concern over possible claims arising from the hurricane. This turmoil vividly illustrates how extreme weather events can wreak havoc on financial stability within the insurance industry, serving as a poignant reminder of the volatility inherent in this sector. As hurricane season intensifies, investors must remain vigilant, reevaluating their risk exposure and strategies accordingly.

Shifting Dynamics in the Bond Market Amid Rising Yields

Amidst these stock market fluctuations, the bond market is under pressure, particularly as Treasury yields have reached notable highs. The 10-year Treasury yield has surged above 4%, a peak not seen in over two months, raising alarms about potential inflation and economic instability. In addition, the six-month T-bill yield has climbed to 4.46%, prompting discussions among investors about the implications for fixed-income strategies moving forward. These rising yields challenge conventional investing wisdom and provoke critical considerations about portfolio adjustments. Understanding the intricate relationship between stock movements and bond yields is crucial, as investors navigate this evolving financial landscape. As the market grapples with these changes, strategic foresight will be necessary to make informed investment decisions.

Loading...