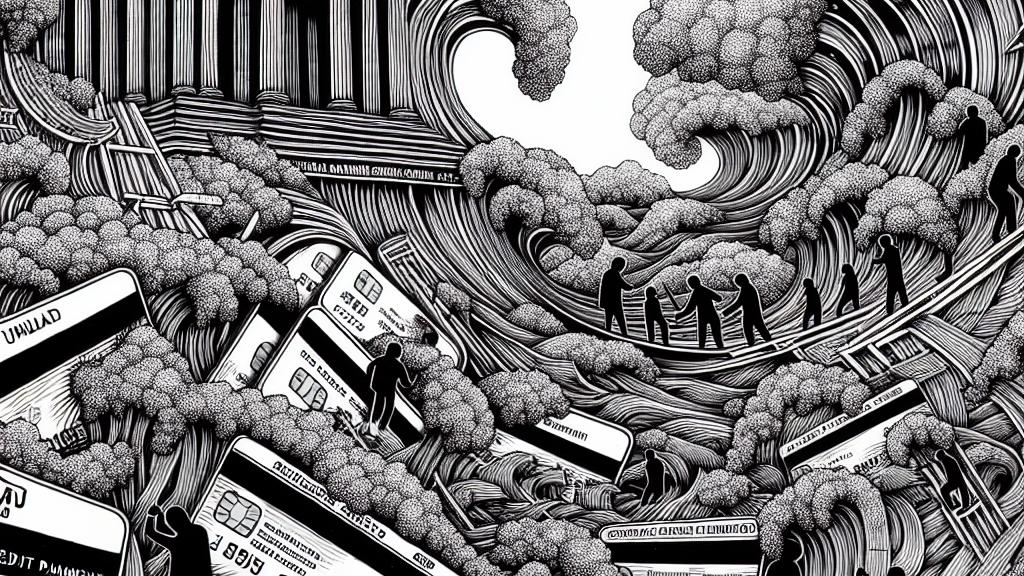

Thailand's Credit Card Relief: 8% Minimum Payment Stays Until 2025!

Overview

- The Bank of Thailand has decided to keep the minimum credit card payment at 8% until the end of 2025.

- This measure aims to assist vulnerable borrowers still facing financial difficulties from the pandemic.

- Household debt in Thailand has surged, underscoring the need for protective financial measures.

Understanding Thailand's Financial Landscape

The Bank of Thailand's recent announcement to maintain the minimum credit card payment at 8% until December 2025 signals a significant strategy to protect consumers during tough economic times. Originally set to revert to 10%, this decision reflects an understanding of the ongoing struggles many individuals face after the financial impact of the COVID-19 pandemic. The previous adjustment from 10% to 5% allowed for immediate relief during the pandemic, and raising it to 8% this year positioned the central bank to be both cautious and responsive to the realities of household finances.

The Impact on Households and Government Policy

This policy extension directly addresses the alarming rise in household debt in Thailand, which has reached approximately 16 trillion baht, accounting for 90.8% of the country's GDP. Many families are struggling to meet their financial obligations, and nearly all surveyed consumers reported having some form of debt. The recommendation by Finance Minister Pichai Chunhavajira to revert the minimum payment to 5% highlights the urgency many lawmakers feel about the issue. Nonetheless, the government chose a more measured approach to ensure debt management strategies lead to sustainable economic conditions, rather than simply provide immediate, short-term relief.

Long-Term Economic Implications and Consumer Education

Considering the Bank of Thailand has labeled high household debt as a 'chronic disease,' it emphasizes the need for comprehensive solutions that include financial education to combat future borrowing pitfalls. Maintaining the minimum credit card payment at 8% aims to encourage responsible credit use while also urging consumers to take a proactive approach in managing their debts. Educating individuals on the potential consequences of only making minimum payments is critical; many do not realize this can result in significantly higher total interest charges over time. Initiatives aimed at boosting financial literacy will empower consumers, leading to better decision-making in their financial lives and a healthier economic environment overall.

Loading...