Biden's Bold Move: Blocking Japanese Steel Takeover?

Overview

- President Biden prepares to officially block Nippon Steel's acquisition of US Steel.

- Bipartisan political opposition intensified from labor unions to influential political figures.

- The decision carries significant risks for US Steel's operations and American job security.

Context and Importance of the Acquisition

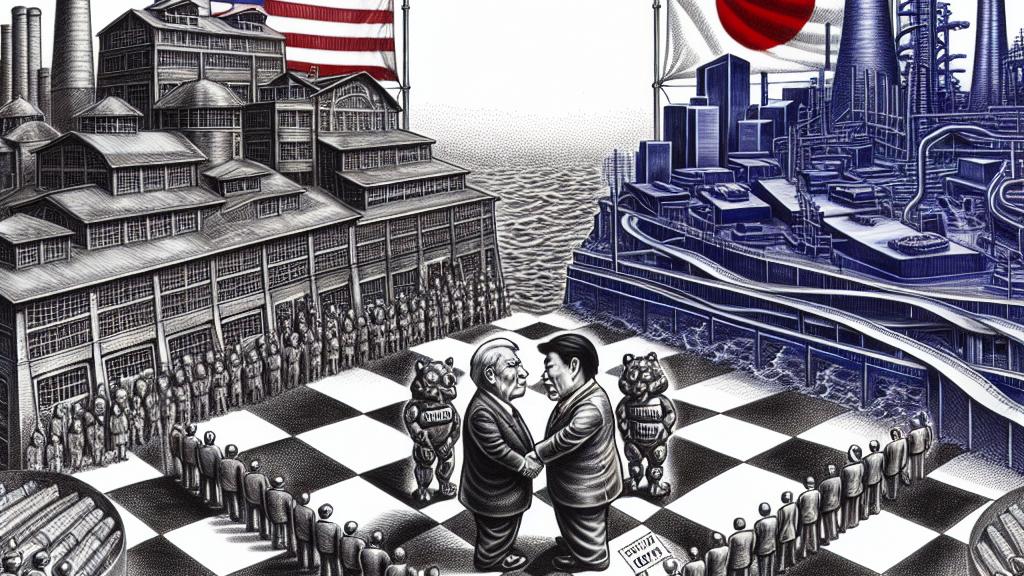

In a noteworthy political maneuver, President Biden is reportedly on the verge of blocking the proposed acquisition of US Steel by Japan's Nippon Steel, which has emerged as a major issue in U.S. economic policy discussions. Valued at approximately $18 billion, this acquisition reflects Japan’s ambition to consolidate its presence in global steel production while raising critical questions about foreign control over American manufacturing. US Steel, established in 1901, is not merely significant for its economic output; it is a historic symbol of America's industrial prowess. Thus, this potential acquisition has sparked a complex debate about national identity, economic sovereignty, and the implications of foreign direct investment in essential sectors.

Political Opposition and Public Sentiment

Opposition to the acquisition resonates across the political spectrum, fueled by concerns from various parties, including labor unions and high-profile political figures. Vice President Kamala Harris has emphasized the necessity for US Steel to remain under U.S. ownership, highlighting its historical importance and its role in supporting American jobs. Former President Donald Trump has similarly condemned the takeover, framing it as an encroachment on American industry that could lead to significant job losses. This sentiment is echoed by many labor organizations whose members fear that foreign ownership could prioritize investor profits over domestic labor considerations. As public sentiment shifts toward protecting American industry, this issue underscores a rising nationalism that prioritizes jobs and economic integrity over globalization.

Potential Consequences and Strategic Implications

Blocking this acquisition has profound implications for both Nippon Steel and the future of US Steel’s operations. The CEO of US Steel has warned that if the acquisition does not go through, the company may face substantial operational challenges, including potential plant closures in key regions such as Pennsylvania, leading to thousands of job losses. Biden's administration is also tasked with considering broader national security implications, as foreign investments in critical industries raise alarms regarding national integrity and market stability. The decision, therefore, not only involves economic calculations but also geopolitical considerations, reinforcing the notion that foreign acquisitions in key sectors may require heightened scrutiny. As the political climate evolves with the upcoming elections, Biden’s decision will shape voter opinions and economic strategies, reflecting the ongoing tug-of-war between globalization and national interests.

Loading...