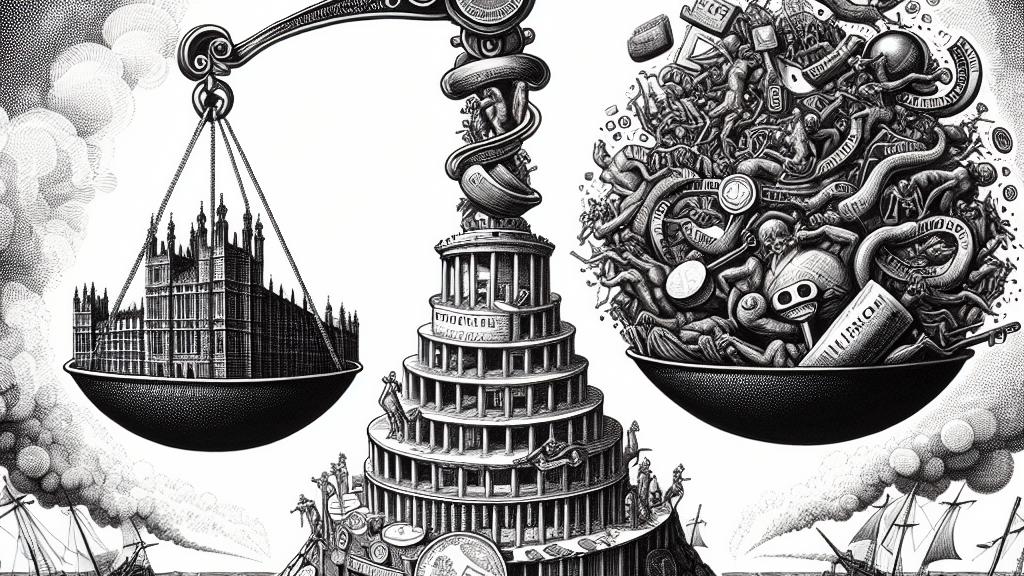

UK Debt Reaches 100% of GDP: Challenges Ahead for Finance Minister

Overview

- In a historic turn, the UK's government debt has surged to a staggering 100% of GDP, marking a significant economic milestone.

- This unprecedented level of debt, coupled with soaring budget deficits, presents formidable challenges for Finance Minister Rachel Reeves as she prepares her upcoming budget.

- Anticipated tax increases alongside proposed service cuts may be necessary strategies to navigate this complex fiscal landscape.

An Alarming Shift in UK Debt Levels

In September 2024, the United Kingdom confronted a stark economic reality: government debt skyrocketed to an astonishing 100% of the nation’s gross domestic product (GDP) for the first time since 1993. This milestone starkly illustrates the gravity of the financial situation, highlighting a significant shift that demands immediate attention. The increase from 99.3% in just two months is largely driven by the lingering impacts of the global financial crisis and the staggering expenditures related to the COVID-19 pandemic. Additionally, as the government continues to grapple with the widening gap between rising public spending and sluggish revenue generation, the implications of such a fiscal predicament become increasingly troubling. For instance, during the early months of 2024, various economic indicators, including inflation and public borrowing, indicated a troubling trend that could have long-lasting effects on economic growth.

Fiscal Challenges and Impending Taxation

As Finance Minister Rachel Reeves steps into the spotlight, the magnitude of her responsibilities looms large. With a staggering £13.734 billion borrowed in August alone, the UK is faced with a formidable budget deficit that necessitates decisive action. In her upcoming budget, Reeves has hinted at the potential necessity for tax increases, aiming to stabilize the country's finances. However, she has ruled out adjustments to income, corporation, and value-added taxes, a move that complicates her fiscal strategy. This leaves her with the complex task of addressing immediate financial needs while trying to keep public sentiment in check. Will she find a way to balance the pressing demands for economic revival with the need for citizen satisfaction? This question hangs in the air, emphasizing the stakes involved.

The Distracting Overspend and Future Prospects

Compounding the situation, the Treasury has unveiled a worrying £21.9 billion overspend this fiscal year—an indicator of significant misalignment between planned and actual expenses. This overspending raises serious questions about the sustainability of current government policies and could lead to indispensable cuts in crucial public services. For example, there are discussions about scaling back benefits and deferring essential infrastructure projects that satisfy community needs. To tackle this fiscal gap, Reeves has proposed initial cuts of £5.5 billion this year, which could escalate to £8.1 billion next year, a move that undoubtedly carries risks of public discontent. While these cuts are framed as necessary to secure the financial future, they may exacerbate the public's struggle amidst rising living costs. Ultimately, as the UK negotiates this precarious fiscal landscape, the government's path forward is fraught with tough decisions and the pressing need for transparency and fairness in its economic policies.

Loading...