Understanding China's Economic Crisis and Recovery Challenges

Overview

- China experiences an unprecedented economic crisis fueled by internal issues and external pressures.

- Inexperienced crisis management complicates efforts to stabilize the economy.

- To achieve sustainable growth, proactive policy reforms and continuous support are critical.

Current State of China's Economy

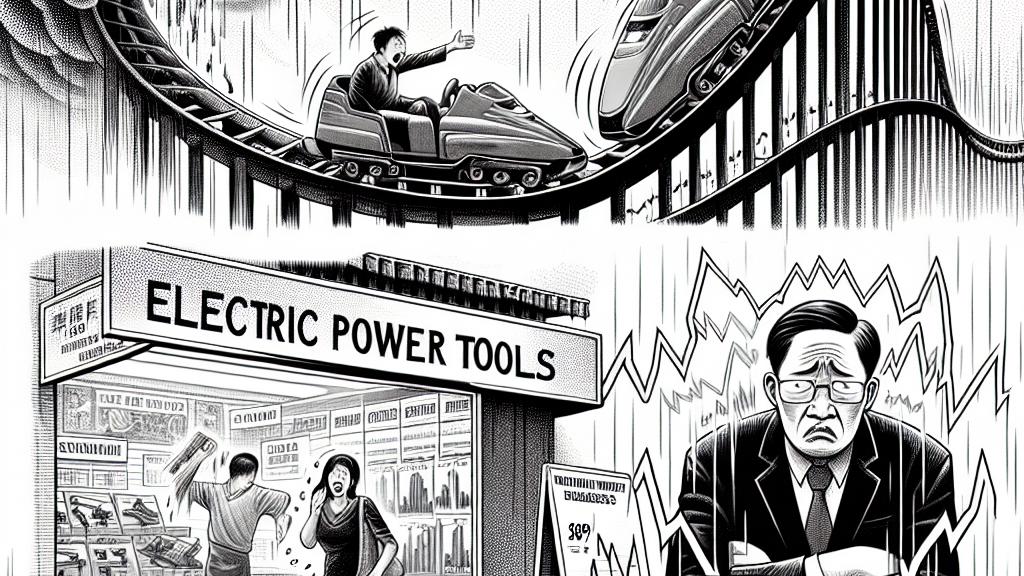

China's economy today is like a roller coaster—filled with thrilling highs and crushing lows. Over the past few years, various factors have contributed to this instability, chief among them being the aftershocks of the global pandemic. Take the case of Zack Yao, for instance; as a 37-year-old business owner in Zhejiang, he vividly recalls the chaos that unfolded. When lockdowns were implemented, his sales of electric power tools dropped to nearly zero; it was as if a dark cloud had settled over his business. However, just as hope began to emerge with the end of some restrictions, new cases surged, leading to snap lockdowns that sent markets back into a tailspin. This persistent unpredictability weighs heavily on many entrepreneurs, leaving them in a constant state of anxiety about when the storm will finally lift.

Challenges in Recovery

The road to recovery is punctuated by daunting challenges that not only highlight the inexperience of China's leadership in handling economic crises but also reveal deep-rooted structural issues. For instance, the World Bank recently noted that China's high debt poses a significant obstacle to growth, akin to a hefty anchor holding down a boat in turbulent waters. Consider the critical real estate sector, which has been on a downward spiral; experts warn that its decline might extend longer than anticipated, trapping consumers in a cycle of anxiety and reduced spending. As families hesitate to make significant purchases, citing fears of financial instability, the overall economy feels the pinch. Drawing from historical parallels, such as Japan's protracted economic difficulties in the 1990s, underscores the need for immediate action that addresses these systemic problems without delay.

The Path Forward

As China stands at this crossroads, experts urge that immediate and strategic reforms are essential for navigating the turbulent landscape ahead. Imagine a climber scaling a steep mountain, where each reform acts as a crucial foothold—without them, the ascent becomes perilous. To begin, proposals include adjusting the debt resolution framework to alleviate financial pressure, alongside measures that foster small business growth. These businesses are the backbone of the economy and, by supporting them, China could stimulate innovation and create jobs. Furthermore, enhancing the social safety net will not only protect vulnerable populations but also promote broader participation in economic recovery. Encouraging households to spend rather than save is vital, and this can be achieved by implementing policies that boost consumer confidence. In this intricate dance of recovery, the choices made today will intricately weave the fabric of China's economic future—potentially leading to a flourishing and sustainable landscape.

Loading...