Transforming Lives: M-KOPA's Pay-As-You-Go Revolution in Africa

Overview

- M-KOPA empowers more than 5 million customers across Africa with innovative pay-as-you-go financing solutions.

- This inspiring model makes vital technologies accessible while promoting individual and community economic growth.

- Committed to enhancing digital inclusion, M-KOPA seeks to transform local economies and change lives for the better.

A Groundbreaking Financial Model for the Unbanked

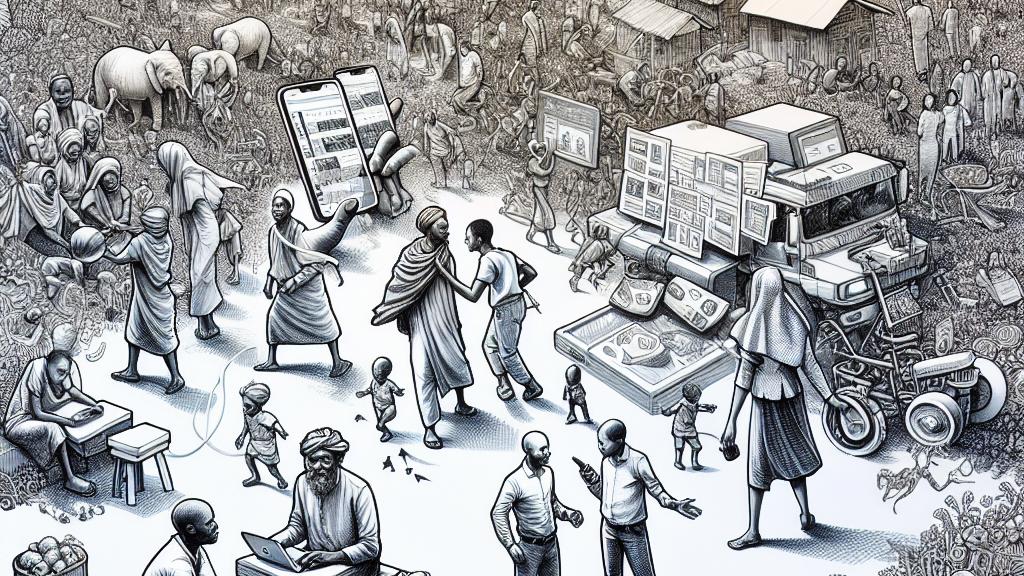

In the dynamic landscape of Kenya, M-KOPA is leading a financial revolution that defies traditional banking constraints. With a staggering 75% of adults in sub-Saharan Africa unable to tap into conventional banking services, M-KOPA's pay-as-you-go model is a game-changer. Picture this: individuals can own essential technologies—like smartphones or solar power systems—by committing to small daily payments of approximately $0.50. This approach not only democratizes access to technology but empowers users to cultivate their credit histories, setting them on a vibrant path toward financial independence and opportunity. Ultimately, M-KOPA is not just a service; it’s a vital lifeline connecting the unbanked to the burgeoning digital economy.

Transformative Impact on Lives and Communities

The profound impact of M-KOPA on its users and communities is truly remarkable! An astounding 92% of customers confirm enhanced access to critical technology, while 80% acknowledge significant improvements in their quality of life thanks to M-KOPA’s offerings. Consider a small business owner who leverages M-KOPA's solar power system to reduce energy costs and increase productivity—this is just one example of how technology can empower people. Interestingly, around 62% of users rely on M-KOPA products to generate income, highlighting their dual role as tools for self-improvement. Moreover, the establishment of Kenya’s largest smartphone assembly plant reflects M-KOPA’s commitment to local job creation and economic growth. By producing affordable smartphones locally, M-KOPA has opened the doors to mobile internet for nearly 2 million newcomers, marking a thrilling step toward bridging the digital divide in Africa.

Overcoming Challenges and Shaping a Bright Future

Yet, M-KOPA’s journey is not without its challenges. Critics have raised concerns regarding the high-interest rates associated with financing options and the unsettling ability to remotely lock devices. These factors invoke essential discussions about consumer privacy and financial responsibility. Nevertheless, M-KOPA is forging ahead unflinchingly, with aspirations to bolster its female customer base to 50% while simultaneously striving to reduce its environmental footprint. For instance, introducing electric motorbikes as eco-friendly alternatives demonstrates their commitment to sustainability in practice. As they continually adapt and innovate, M-KOPA is not just shaping a more inclusive financial landscape; they are also charting a transformative path toward economic empowerment for individuals and communities across Africa. The potential for positive change is immense, and M-KOPA is at the forefront of this exhilarating movement.

Loading...