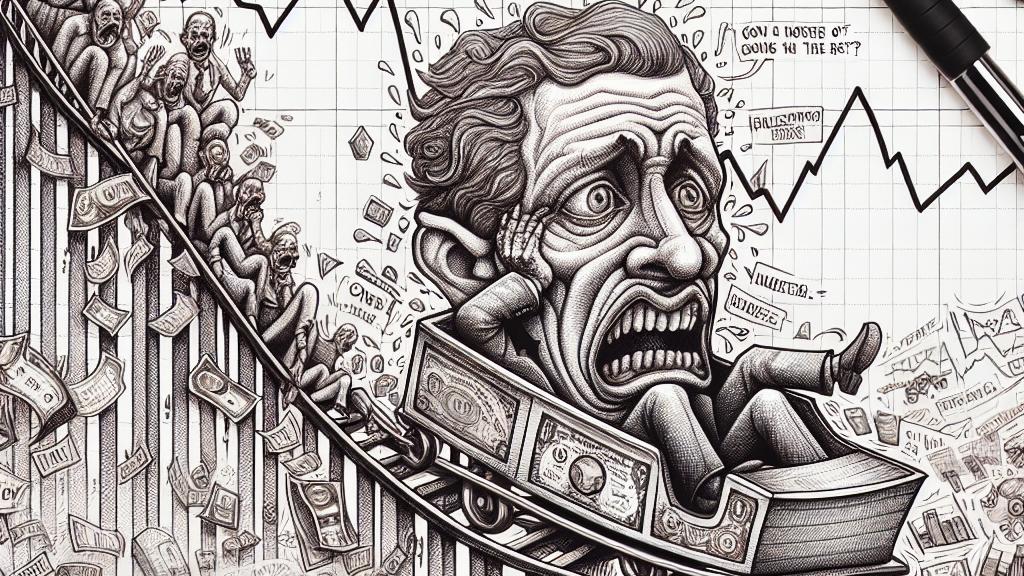

Stock Price Rollercoaster: New NISA and Orcan Investing Insights!

Overview

- Stock prices have fallen about 10% since mid-July, impacting many investors' sentiments and decisions.

- The New NISA has shown varying degrees of success, benefiting early investors while presenting challenges for those who joined later.

- Strategies emphasizing resilience are essential, encouraging investors to stick to their plans despite market volatility.

In-Depth Analysis of Current Market Trends

Japan's stock market has been in a state of flux, with prices recently declining approximately 10% since mid-July. This sharp drop is particularly significant for participants in the new NISA program, launched six months ago, which is designed to encourage long-term investment. Investors who started early may still rejoice in modest gains, while those who entered the market later are grappling with slight losses. Despite this volatility, data indicates a growing number of individuals are committing to consistent investments in index funds like Orcan. This trend highlights a strong belief in long-term wealth-building strategies regardless of short-term market turbulence.

Psychological Impacts of Stock Price Fluctuations

The emotional consequences of a declining stock market can be profound, often leading to a heightened sense of anxiety and distress among investors. Studies consistently show that people feel losses more acutely than gains, which can skew perceptions and decision-making. Historically, the stock market experiences natural cycles of ups and downs, and while recent declines may feel alarming, they pose potential buying opportunities. Adopting a positive outlook can help investors leverage these downturns to purchase shares at lower prices, contributing to their long-term financial goals. This mentality is vital for maintaining composure and perspective amid the noise of market fluctuations.

Strategic Approaches to Orcan Investments in Uncertain Times

For Orcan investors, the focus should shift from fear to proactive engagement during these unpredictable market conditions. Staying committed to regular investment contributions is crucial, as current price dips represent a chance to acquire shares at discounted rates, thereby positioning for future growth when the market rebounds. Establishing a long-term investment perspective fosters resilience against emotional fluctuations caused by stock price movements. However, if investors find themselves overwhelmed by anxiety stemming from market drops, it is reasonable to reassess and potentially reduce investment amounts temporarily. This adjustment allows for a balanced approach, fostering mental well-being while remaining engaged in the investment process and safeguarding against any long-lasting negative impacts.

Loading...