Understanding the Issues of Taxation and Social Security

Overview

- Explores the complexities of Japan's 1.03 million yen income threshold and real-life consequences.

- Examines the impact of outdated family models on taxation fairness and implications.

- Critically assesses the shortcomings of the current social security system in a modern context.

Challenging the 1.03 Million Yen Barrier

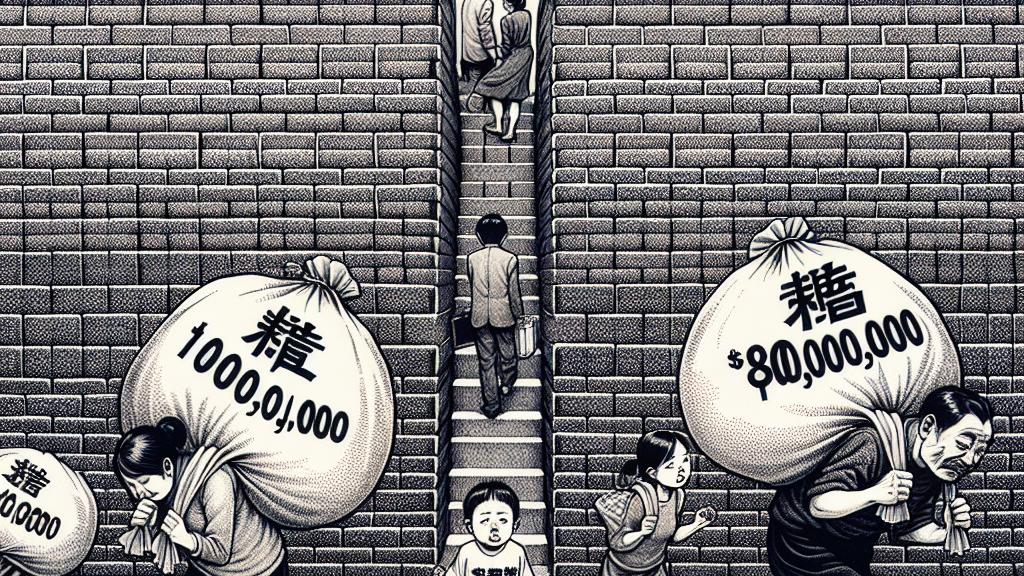

In Japan, the much-discussed '1.03 million yen barrier' has sparked intense debate among policymakers and families alike. This threshold, set decades ago, stems from a time when single-income households were the norm, yet it no longer fits today’s reality. Picture a dynamic family where both parents work part-time, each earning 800,000 yen. Together, they bring in 1.6 million yen, yet they often end up paying greater taxes than a traditional single-income family earning the same amount. This inequity is more than just frustrating; it fundamentally questions the fairness of our tax system. In response, leaders from the National Democratic Party have proposed raising this limit to better reflect modern economic conditions, especially as inflation continues to rise. However, any change must be thoughtfully paired with discussions on how to fund such adjustments to avoid exacerbating Japan's already challenging fiscal landscape.

Outdated Family Models and Inequities

The outdated notion of one income earner supporting an entire family is not just a relic—it's a contributing factor to considerable inequities within Japan's taxation framework. Imagine two households: one where a dad earns 1.5 million yen alone, and another where both parents contribute 750,000 yen each for a combined income of 1.5 million yen. Surprisingly, the dual-income household often faces a heavier tax burden despite the same financial outcome. Isn't it perplexing? This inconsistency not only raises serious concerns but also highlights a critical flaw in the current structure. Moreover, consider the starker injustice faced by families without children; why should they pay the same taxes as those who are raising the next generation? Rethinking our tax policies to better account for various family structures will help ensure that we're fostering a fairer society, one where all families feel their contributions are recognized and valued.

Social Security's Inadequate Framework

Looking deeper into Japan's social security system reveals a framework that struggles to keep pace with societal changes. As it stands, younger working-age individuals are often burdened with a disproportionate amount of taxes to support an aging population that no longer actively contributes to state revenues. Visualize a young professional, already managing their own expenses and dreams, finding that significant portions of their income are funneled toward supporting retirees. This unsustainable cycle requires urgent reforms. To preserve and enhance the value of our social security system, we must prioritize fairness and transparency while recognizing the needs of all citizens—young and old. For instance, adjusting social security contributions can alleviate the pressure from the younger generation, ensuring that their hard work pays off and aligns with their future. By doing this, we foster an atmosphere of equity and support, crucial for a thriving, sustainable society.

Loading...