Request for Fundamental Review of Hometown Tax System by Governor Koike

Overview

- Governor Koike highlights alarming tax revenue declines linked to the hometown tax system.

- She urges a comprehensive review to correct funding distortions and restore equity.

- The contrast between thriving rural areas and struggling urban municipalities calls for immediate action.

Understanding the Hurdles of the Hometown Tax

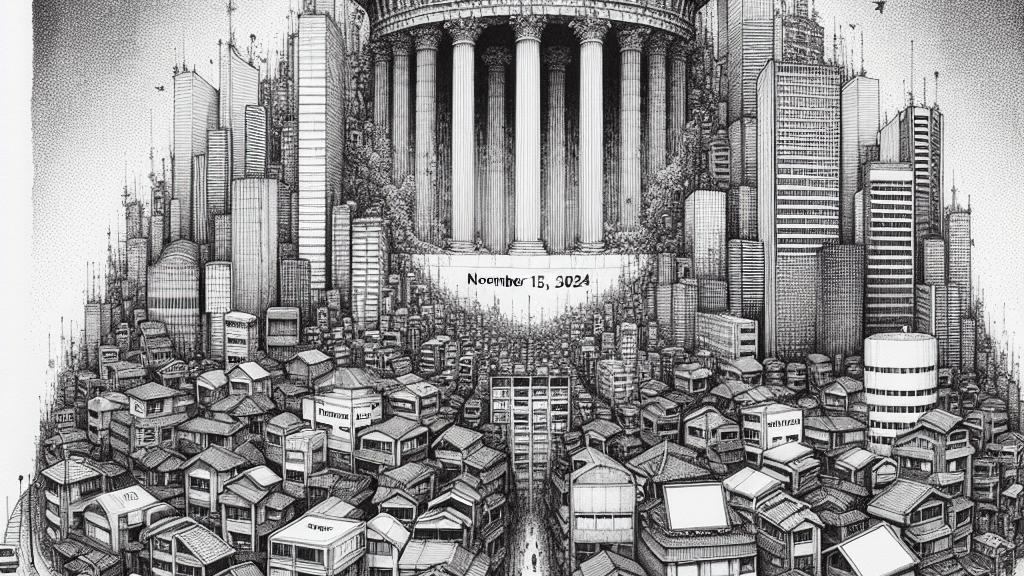

In the bustling heart of Tokyo, Governor Koike is raising critical concerns regarding the well-intentioned yet flawed hometown tax system, known as 'furusato nozei.' Designed to allow residents to contribute financially to their home municipalities, this system has inadvertently tied the hands of urban communities, resulting in devastating tax revenue losses. Consider Setagaya, one of Tokyo's largest wards, where projected revenue losses exceed 110 billion yen for the current year. This figure starkly contrasts with just a decade ago, highlighting an astonishing 120-fold increase in financial strain. Koike passionately argues that, instead of nurturing a culture of giving, the system has devolved into what she refers to as a 'government-controlled shopping' platform. During her press conference on November 15, 2024, she reiterated her demand for a comprehensive national evaluation, emphasizing that the core principles of community support and equity are at grave risk.

Success Stories from Rural Areas

However, it's important to recognize that the hometown tax system bears different fruits depending on the region. While Tokyo grapples with financial losses, rural areas have, in some cases, experienced remarkable success stories. Take Chiyoda Town in Gunma Prefecture, for instance. Here, local breweries have garnered significant attention, leading to an impressive 30 billion yen raised in donations last year—a sum that accounts for one-third of the entire town's revenue! This influx of funds has been earmarked for vital community initiatives, from enhancing educational facilities to expanding childcare support. The difference is stark: where urban areas are stifled by funding pressures, rural regions thrive by embracing local uniqueness and incentivizing contributions. This illustrates that the hometown tax, when applied thoughtfully, can be a tremendous asset in promoting local development and rejuvenation.

A Rallying Cry for Reform

As discussions around this complex issue evolve, experts voice a pressing need for transparent communication with residents. By fostering a better understanding of how the hometown tax system influences local governance, communities can make informed decisions regarding their contributions. Koike is committed to collaborating with municipalities to pinpoint and amend any adverse incentives embedded in the current model. The juxtaposition of Tokyo’s hardships against the success stories from rural areas compellingly underscores the urgent necessity for reform. This call for change transcends mere tax adjustments; it represents an opportunity to reforge bonds within communities and ensure they receive robust public services tailored to their unique needs. By realigning the system with its original intent, we can reignite the spirit of local engagement and support—a vision that should define Japan's approach to governance and community welfare.

Loading...