Understanding Pension Systems and Retirement Funds

Overview

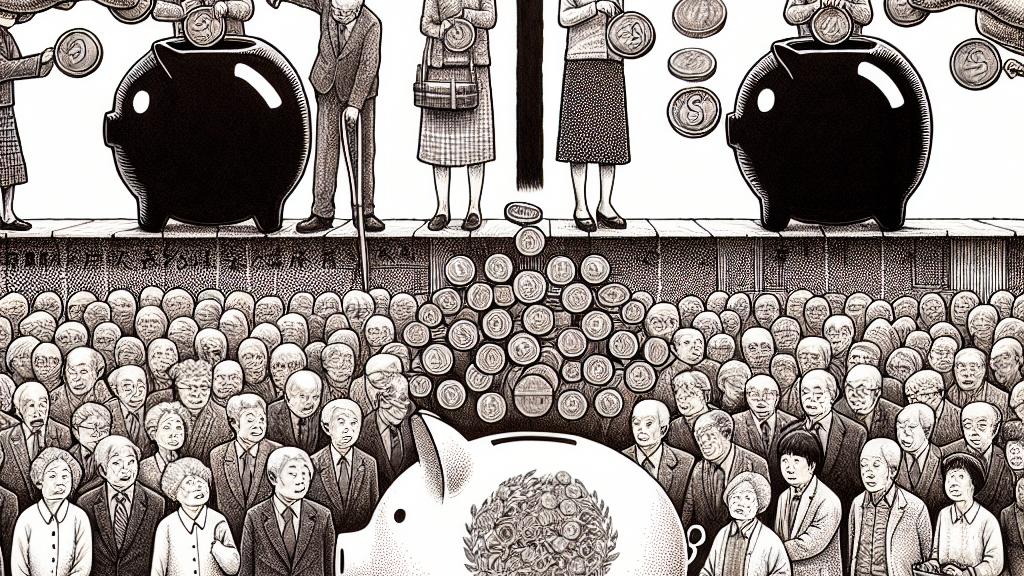

- Japan's increasing life expectancy reshapes the landscape of pension systems and retirement planning.

- While pensions are essential for covering retirement expenses, they often alone cannot sustain a comfortable lifestyle.

- A proactive approach to saving and investing is key to ensuring financial security and peace of mind in retirement.

Pension System Overview

The Japanese pension system comprises two main components: the National Pension, which serves self-employed individuals, and the Employees' Pension Insurance, catering to salaried workers. Let's break this down: Self-employed folks contribute approximately 20,000 yen monthly from age 20 to 60, which leads to around 65,000 yen in monthly benefits starting at 65. On the flip side, salaried employees contribute roughly 31,000 yen a month until age 65, allowing them to expect a combined pension of about 140,000 yen monthly. What's fascinating is that life expectancy in Japan now averages over 84 years, which underlines the necessity for individuals to not only understand these intricate systems but also strategize their finances accordingly. As the landscape continues to evolve, so too must our approach to retirement savings.

Current Challenges in Pension Finance

Recent findings from the Japanese government highlight some alarming trends in pension finance. Specifically, the National Pension system is facing significant fiscal stress, which could potentially translate into a 20% reduction in retirement benefits for many. Contrast this with the relatively stable Employees' Pension, which encourages wider participation in its programs. Given that Japan has one of the highest life expectancies globally—81 years for men and nearing 87 for women—this situation amplifies the urgency for essential reforms. Imagine a world where adapting retirement age and contribution levels is crucial for ensuring that future generations are not left behind. It’s a daunting task, yet necessary for the sustainability of our social support systems.

Planning for Retirement Expenses

To secure a financially sound retirement, it's imperative to adopt a multifaceted planning strategy. Experts consistently recommend a mix of regular savings, innovative investment avenues like NISA and iDeCo, which provide tax benefits, and vigilant financial planning. Consider this: a retiree could need anywhere between 1,000 and 4,590 million yen, depending greatly on lifestyle choices and spending habits. For instance, a retiree who loves to travel may require a substantially larger retirement fund compared to someone preferring a simpler, home-oriented lifestyle. Interestingly, as people age, their expenses often decrease, allowing pensions to cover a significant portion of living costs if organized effectively. Therefore, prioritizing savings and investments from an early age—a few thousand yen each month can compound significantly over time—will crucially empower individuals to live their later years with joy and freedom, free from the strain of financial insecurities. Adopt a proactive mindset today to foster a secure and fulfilling retirement tomorrow!

Loading...