Chase Bank's Viral ATM Glitch: Free Money or Fraud?

Overview

- Chase Bank addresses viral videos of ATM fraud attempts during Labor Day weekend.

- Warnings issued against depositing fraudulent checks as they lead to legal issues.

- Examination of check kiting as a notable historical form of banking fraud.

Overview of the Incident

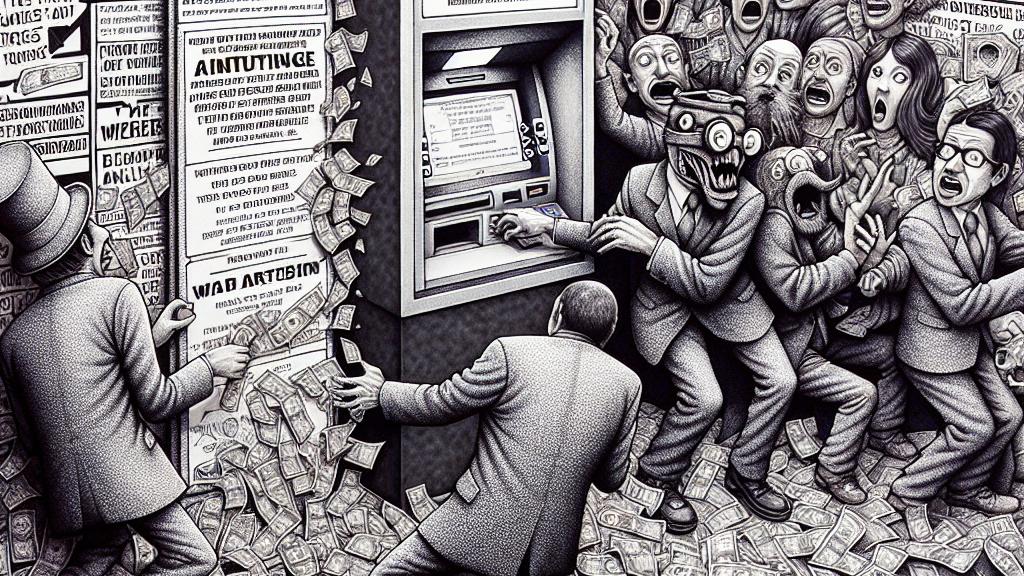

In September 2024, a controversial series of videos took social media by storm, particularly on TikTok, showing individuals allegedly exploiting a flaw in Chase Bank's ATM system during the Labor Day weekend. These viral clips portrayed people depositing fraudulent checks for astonishing amounts and then withdrawing cash, mistakenly believing they had discovered a loophole that allowed them to access free money. In response, Chase Bank quickly released a public statement clarifying that these actions constituted fraud and warned customers against mimicking this unethical behavior. They emphasized that such attempts would not only fail but could lead to severe legal repercussions, including prosecution for fraud. This incident underscores the critical need for financial literacy and understanding of banking ethics among consumers.

Understanding the Legal Ramifications

Engaging in fraudulent activities, particularly those that exploit banking systems, carries significant legal risks. Check kiting, a fraudulent practice where individuals write checks from accounts lacking funds and withdraw money before the checks clear, remains a prevalent issue in the financial sector. This method of deception can lead to felony charges, resulting in considerable fines and potential imprisonment. Experts in financial crime stress that committing these acts can have devastating consequences not just for the perpetrator but also for trust in financial institutions. Financial advisors warn those who might consider such fraudulent actions to think carefully about the long-term implications on their lives, family, and reputations, reinforcing the moral obligation individuals have in their financial dealings.

Check Kiting: A Historical Perspective on Fraud

The long history of check kiting provides insight into how financial fraud has evolved. This practice typically involves manipulating banking systems to create an illusion of available funds without any actual backing. A notorious case is that of Dan Saunders, an Australian bartender, who discovered a glitch that allowed him to withdraw massive sums of money illegally. His experience, which began as a heist for quick wealth, turned into a poignant narrative of how quickly such actions can unravel, leading to anxiety and eventual confrontation with the law. Saunders's story serves as a reminder that while illicit opportunities may seem enticing, they carry the weight of potential consequences that can follow an individual for years. This case crystallizes the importance of integrity in financial practices and the notion that crime, even if briefly rewarding, often leads down a path of regret and turmoil.

Loading...