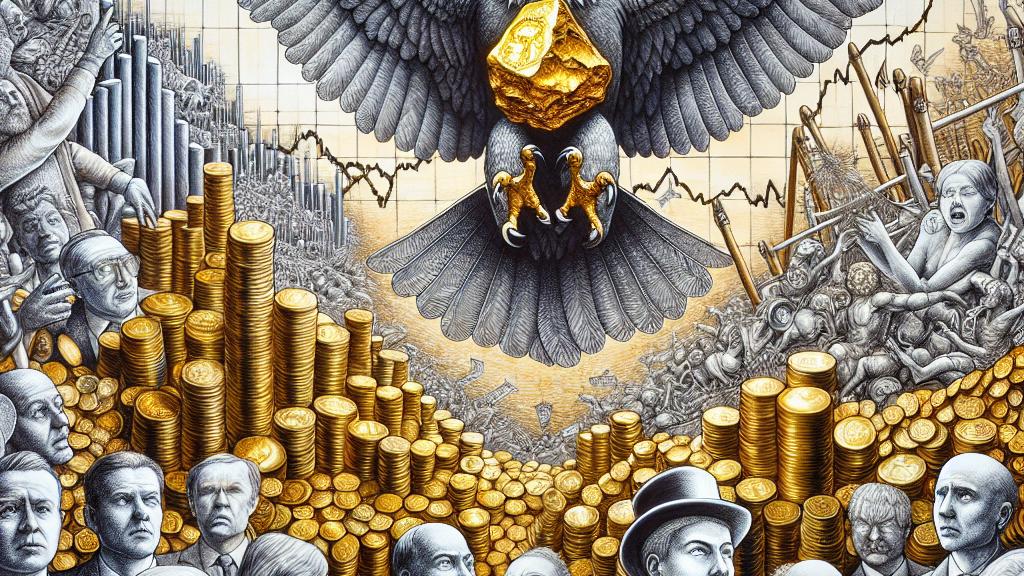

Gold Soars High: Will the Fed's Move Make It Glitter Even More?

Overview

- Gold prices have surged to an all-time high of US$2,531 per ounce.

- Market expectations are building around a potential Federal Reserve interest rate cut.

- Geopolitical tensions worldwide are further enhancing gold's appeal as a secure investment option.

The Historic Surge of Gold Prices

In recent weeks, gold prices in Thailand have surged to a remarkable peak of US$2,531 per ounce, marking a historic milestone for the precious metal. This increase stems from a combination of factors, including mounting investor interest in gold as a safe haven amidst economic uncertainty. With the Federal Reserve's upcoming meeting in September, traders are on high alert for any signs of a potential interest rate cut. Historically, lower interest rates diminish the opportunity cost associated with holding gold, making it a more attractive investment. As a result, many investors are flocking to gold, aiming to capitalize on its perceived stability in turbulent times.

Anticipation Around Federal Reserve Actions

The minutes from the Federal Reserve's July meetings have revealed a significant inclination among officials towards easing interest rates in September if economic data allows. This sentiment has been received positively in markets, which are now fully anticipating such a cut. Analysts suggest that if the Fed announces a more substantial reduction than the market expects, gold prices could soar even further. This anticipation sets the stage for significant movement in the gold market, as traders are willing to adjust their strategies based on the Fed's decisions. A rate cut could bring numerous benefits to gold investments, potentially positioning gold at the forefront of portfolio strategies aimed at safeguarding wealth against inflation and economic downturns.

Geopolitical Tensions and Market Dynamics

Compounding these economic factors are escalating geopolitical tensions around the globe, particularly the ongoing conflict in Ukraine and heightened strife in the Middle East. Such unrest often drives investors toward gold, appreciating it as a resilient asset during crises. Recent analyses indicate that as geopolitical conflicts continue to unfold, the demand for gold is likely to increase, contributing further to price hikes. With various regions experiencing instability, market observers predict that the dual forces of Federal Reserve actions and geopolitical unrest will continue to create volatility in gold prices. Investors will need to remain vigilant, as the delicate balance between these external factors may influence their investment decisions and risk management strategies moving forward.

Loading...