Financial Struggles of Hong Kong Consumers Amid Rising Incomes

Overview

- A staggering 25% of Hongkongers are unable to pay their bills fully despite rising incomes.

- Economic issues such as inflation are contributing to financial anxiety and instability.

- Implementing effective budgeting and seeking financial advice are crucial to overcoming financial challenges.

Economic Overview of Hong Kong

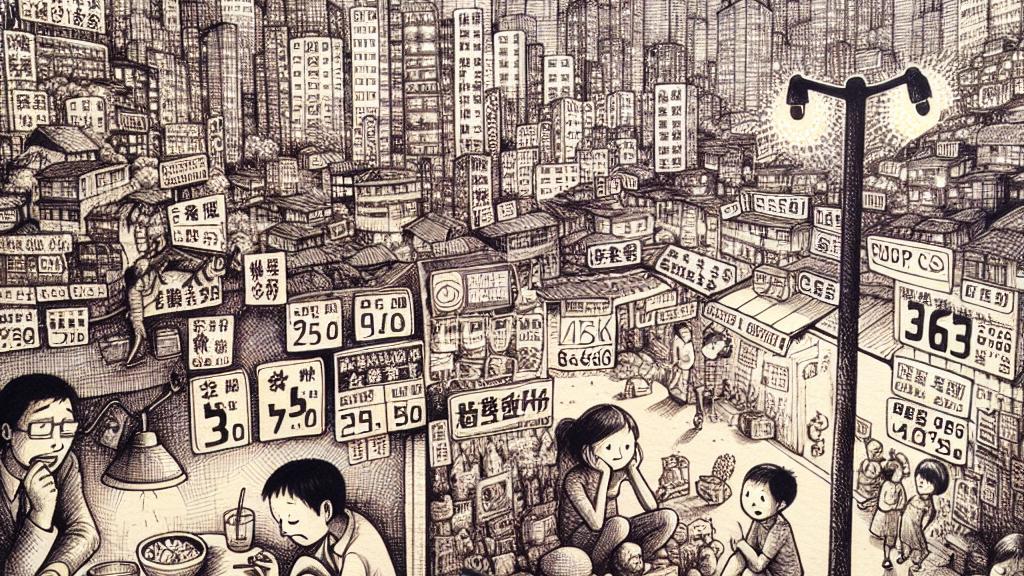

In the bustling metropolis of Hong Kong, where bright lights and vibrant markets define the skyline, a troubling reality confronts its residents. According to a recent report by TransUnion, 25% of the population struggles to cover at least one bill in full—an alarming increase from just 17% the previous year. This financial strain is not merely a number; it reflects the day-to-day struggles of families facing high housing costs, steep grocery prices, and the impacts of inflation. For example, a typical family may find themselves choosing between essentials, like school supplies for their children or paying the electricity bill. Such scenarios are becoming increasingly common, robbing many of the peace of mind that comes with financial security.

The Psychological Impact of Financial Stress

The toll of financial stress is profound, weaving its way into the fabric of daily life like an unwelcome guest. Research shows that many individuals develop anxiety, insomnia, and even physical symptoms such as stomach pain due to money-related worries. Imagine the young professional anxiously staring at her budget, feeling the weight of choices that seem insurmountable. Studies from Ramsey Solutions reveal that nearly 78% of individuals would struggle financially if their paycheck were delayed by a week, emphasizing just how many live paycheck to paycheck. When the very act of managing finances leads to arguments between couples or affects family dynamics, it becomes clear that financial stress is more than a personal issue—it's a societal concern that needs urgent attention.

Strategies to Mitigate Financial Strain

Turning the tide against financial strain requires proactive strategies and a shift in mindset. First, envision tackling your finances like you would a challenging project—start by establishing clear goals. Create a detailed budget that not only tracks income and expenses but also helps identify areas for potential saving, such as those daily coffee runs or subscription services that go unused. For instance, setting aside just HK$200 a week can lead to significant savings for unexpected expenses. Additionally, exploring options for personal loans can provide temporary relief for consumers in a bind. Educating oneself about financial literacy also empowers individuals, paving the way toward making informed decisions that promote financial health. Ultimately, with determination, support, and practical strategies, overcoming financial challenges becomes not just a hope, but an achievable goal.

Loading...