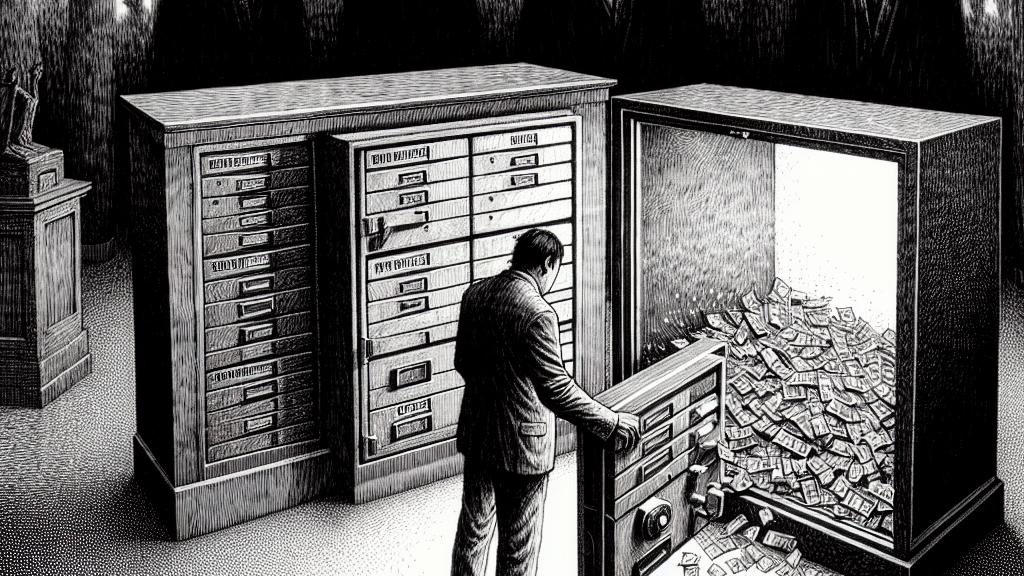

The Disappearance of Cash from Safe Deposit Boxes

Overview

- Recent thefts from safe deposit boxes across Japan have sparked grave concerns about banking security.

- Renowned writer Motoki Adachi shares a chilling personal account of his own loss to highlight the issue.

- As discussions around consumer protection intensify, it's crucial for customers to reassess their trust in banks.

Shocking Developments in Japan

In Japan, the once-reliable institution of banking is facing a serious crisis as unsettling reports emerge about the theft of valuables from safe deposit boxes—considered bastions of security. A recent scandal at Mitsubishi UFJ Bank unveiled a disturbing truth: an employee allegedly orchestrated the theft of billions of yen from customer boxes, exploiting the very trust clients placed in the system. This incident is not an isolated case; it serves as a sobering reminder that even the strongest vaults can fall prey to human greed. Imagine the dread of entering a bank, believing your assets are safe, only to discover that your years of hard work have vanished without a trace. This shocking breach of security prompts broader questions about the integrity of banking practices across the nation.

A Gripping Personal Account

Among those profoundly impacted is writer Motoki Adachi, who recounts his unforgettable experience. Picture this: five years ago, he approached his safe deposit box, eager to retrieve his significant savings of 10 million yen. The moment he opened the box, however, was like plunging into a nightmare—his valuables were gone. The feeling of disbelief swept over him: “Am I losing my mind?” This haunting question resonates with countless others who have also confronted similar heartbreak. Stories like his are no longer rare occurrences. They highlight an increasing pattern of theft and deception that forces us to confront the vulnerability of our financial security. It’s alarming; families may be risking their life savings without even knowing the dangers lurking in their bank's vaults.

Rethinking Trust and Security in Banking

As conversations around banking security continue to gain traction, it’s vital to recognize that customer trust is fundamentally tied to transparency and rigorous security practices. Financial experts are suggesting a complete overhaul of the security measures currently in place. For instance, implementing stringent employee background checks and conducting regular, thorough audits could significantly reduce the risk of internal fraud. Furthermore, banks need to engage in honest communication with their clients about what security measures protect their assets. In an age where cyber threats and internal corruption seem alarmingly prevalent, remaining informed empowers consumers to demand accountability. After all, the more you know, the better you can safeguard your precious assets. It is crucial to foster a banking environment where consumers can confidently store their valuables, knowing their financial safety is the top priority.

Loading...