Innovative Framework for Valuing Intangible Assets Through Games of Chance

Overview

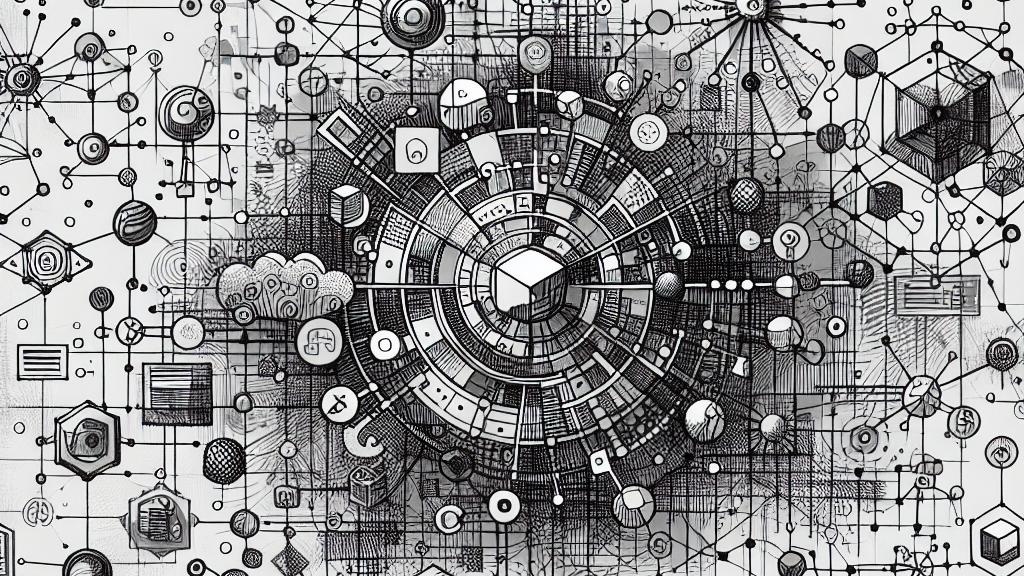

- This transformative model revolutionizes how we price elusive intangible assets, including data and intellectual property.

- Employing the engaging dynamics of games of chance, it establishes clear, accurate monetary valuations.

- It effectively addresses and overcomes the constraints of traditional pricing theories, paving the way for new insights.

Understanding Intangible Assets

In a remarkable development announced in November 2024, researchers at King's College London unveiled a groundbreaking statistical model specifically designed to tackle the complexities of valuing intangible assets such as data and intellectual property. This significant event took place in the United Kingdom and represents a major leap in our understanding of non-physical goods. Traditional pricing models, founded on the principles of supply and demand, often fall short when confronted with the unique nature of intangible assets. For instance, while tangible goods, like electronics, require substantial resources and labor to produce, a dataset can be duplicated infinitely without incurring extra costs. This fundamental difference complicates businesses' ability to accurately assess the monetary worth of their digital assets. As a result, grasping this intricate dynamic is essential for companies aiming to leverage their intangible holdings for competitive advantage.

The Role of Games of Chance

The researchers cleverly used the metaphor of games of chance, such as poker and roulette, to illustrate their model for valuing intangible assets. Just as players in these games operate with varying levels of information and strategy, data sellers and buyers often navigate a marketplace filled with informational asymmetry. Picture a scenario where a data seller possesses critical insights while potential buyers lack the necessary context; in such a case, the seller's competitive edge is at stake. To address this, the innovative framework asserts that a fair price for intangible assets can be derived by carefully considering potential losses in competitive advantage against the amount of information shared. By using this engaging analogy of gaming strategies, the researchers aim not only to provide a clearer understanding of data pricing but also to promote fairness in economic exchanges, ensuring that all parties can effectively navigate the complexities of the digital market.

Implications for Businesses

Ultimately, this innovative framework is poised to empower businesses across a wide range of industries by providing a robust methodology for valuing their intangible assets. By implementing this model, companies can transition from vague pricing strategies to a more transparent and equitable approach to transactions. For instance, take a look at industry leaders like Amazon and Alibaba, who extensively harness customer data to inform their operational decisions. Equipped with the tools provided by this framework, these companies can more accurately evaluate the true worth of their data, setting prices that not only reflect its intrinsic value but also protect their competitive advantages in a fast-paced digital economy. The overarching goal of this research is to establish a comprehensive theory of data pricing that could transform valuation practices, stimulate strategic investments in data initiatives, and ultimately reinforce data's role as a cornerstone of business strategy in our increasingly digital world.

Loading...