Mester Anticipates Fewer Rate Cuts Following Trump's Election Victory

Overview

- Loretta Mester expects reduced rate cuts due to Trump's aggressive tariff proposals.

- Markets have recalibrated their predictions for interest rate reductions in light of Trump's electoral success.

- Concerns are rising among global leaders regarding the broader impacts of tariffs on the world economy.

Understanding the Economic Dynamics After the Election

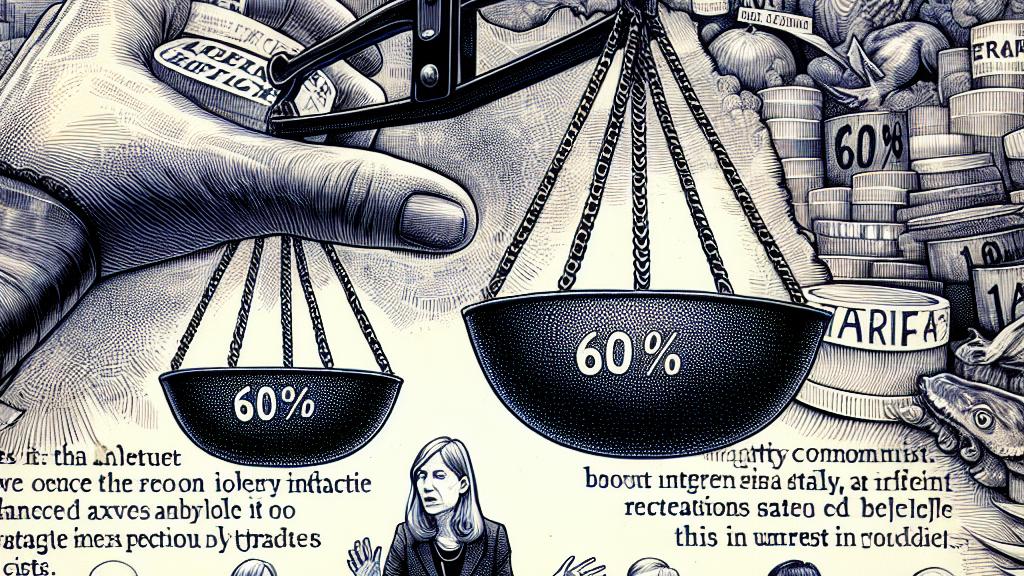

In the wake of Donald Trump's recent election victory, the economic landscape is undergoing a significant transformation. Loretta Mester, the former president of the Cleveland Federal Reserve, shared her insights during a captivating panel discussion in London. She expressed a strong belief that the Federal Reserve will likely implement fewer interest rate cuts than previously projected. This belief is underscored by Trump's ambitious plan to impose hefty tariffs—like an alarming 60% on imports from China. Such drastic actions could unsettle U.S. trade relations and unsettle global markets, prompting the Fed to reevaluate its monetary policy strategies. For instance, if the anticipated tariffs squeeze supplier costs, this could lead to increased inflation, fundamentally altering the Fed's approach.

The Impact of Tariffs on Forecasting Rate Cuts

Mester provided a compelling analysis of how proposed tariffs could stir inflationary pressures, complicating the Fed's plans going forward. Originally, financial markets predicted a series of rate cuts; however, they've recently adjusted their projections, now expecting only a single percentage point reduction in the first half of 2025. This shift in expectations emphasizes a growing awareness of how Trump's incoming fiscal policies might ignite inflation and disrupt economic balance. Notably, during the Fed's pivotal December meeting, we can expect proactive discussions regarding how these changes will influence future economic forecasts. This meeting represents a key moment for investors and economists to gauge the Fed's direction and its responsiveness to evolving fiscal landscapes.

Global Consequences and the Broader Economic Outlook

Moreover, the implications of potential trade wars extend far beyond U.S. boundaries, creating a web of global economic concerns. Voices like Olli Rehn's, a notable policymaker from the European Central Bank, have raised alarms about the harmful effects that high tariffs could have on international trade dynamics. Mester herself carries a cautiously optimistic outlook for the U.S. economy, suggesting that while significant cuts in interest rates may not be on the immediate horizon, the economic terrain remains fraught with complexity. She wisely noted, 'Even if we’re not witnessing drastic cuts, we must remain vigilant about how these economic factors interplay.' Her insights underscore the significance of understanding not just the potential tariffs, but also the overarching influences linked to immigration and tax reforms, all of which will play crucial roles in crafting the economic forecasts for the future.

Loading...