IMF Cautions on Economic Recovery Amid High Debt and Low Growth

Overview

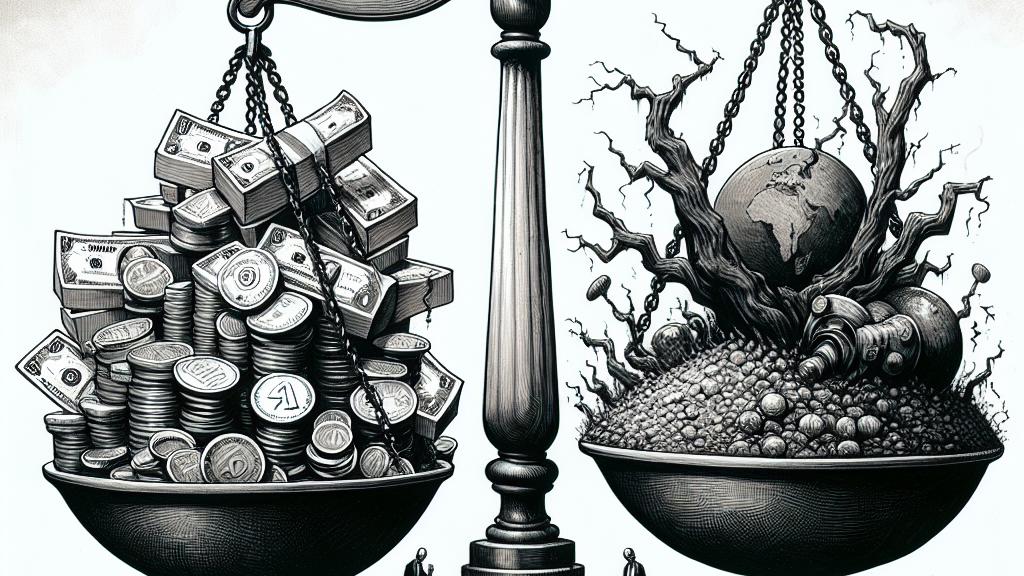

- IMF alerts that ongoing high debt and low growth significantly hinder the global economy.

- The dynamics of international trade are shifting due to rising protectionist policies.

- Geopolitical tensions pose serious risks, threatening financial stability globally.

A Call for Attention to Economic Challenges

At a crucial meeting in Washington D.C., Kristalina Georgieva, the Managing Director of the IMF, sounded the alarm bells regarding the global economic landscape. While there have been encouraging signs of recovery, many nations are still grappling with the dual burdens of soaring debt and persistent low growth—a phenomenon she described as 'anemic growth.' Governments worldwide often rely on substantial borrowing to finance their spending, like infrastructure projects and social programs. Take, for example, the United States, where national debt has skyrocketed to over $34 trillion, compelling policymakers to rethink fiscal strategies. Meanwhile, emerging economies, still struggling to rebound from the profound impacts of the COVID-19 pandemic, find themselves needing urgent reforms to foster resilience and stimulate growth.

Shifting Dynamics in Global Trade

Moreover, Georgieva pointed out a significant transformation in the realm of global trade. The robust engine of growth that trade once represented is losing strength. Increasingly, nations are leaning toward protectionist policies, as illustrated by the ongoing tariff disputes between the U.S. and China. Such measures not only suppress the flow of goods and services but also create an inflated cost structure that directly affects consumers. For instance, the imposition of tariffs leads to higher prices for everyday items, from electronics to clothing, ultimately straining household budgets. This environment of economic nationalism fosters suspicion and undermines international collaboration, making it all the more challenging to unlock the mutual benefits of trade, which are essential for stimulating global economic growth.

Geopolitical Risks Complicating Financial Stability

Finally, the rising tide of geopolitical tensions is another pressing concern threatening the fabric of global financial stability. Georgieva highlighted ongoing conflicts, particularly in the Middle East, as destabilizing elements that ripple through economies worldwide. The fluctuation of oil prices, for example, not only affects oil-exporting countries but also creates uncertainty for nations dependent on stable energy supplies. Regions like Sub-Saharan Africa may face dire economic repercussions due to inflated energy costs. Thus, promoting international collaboration and developing strategic economic frameworks that anticipate these tensions become critical. By approaching financial challenges collectively, nations can build a more resilient global economy—one capable of standing strong against the diverse challenges of today’s interconnected world.

Loading...