Buffett's Bold Moves: Berkshire's Bank of America Bonanza!

Overview

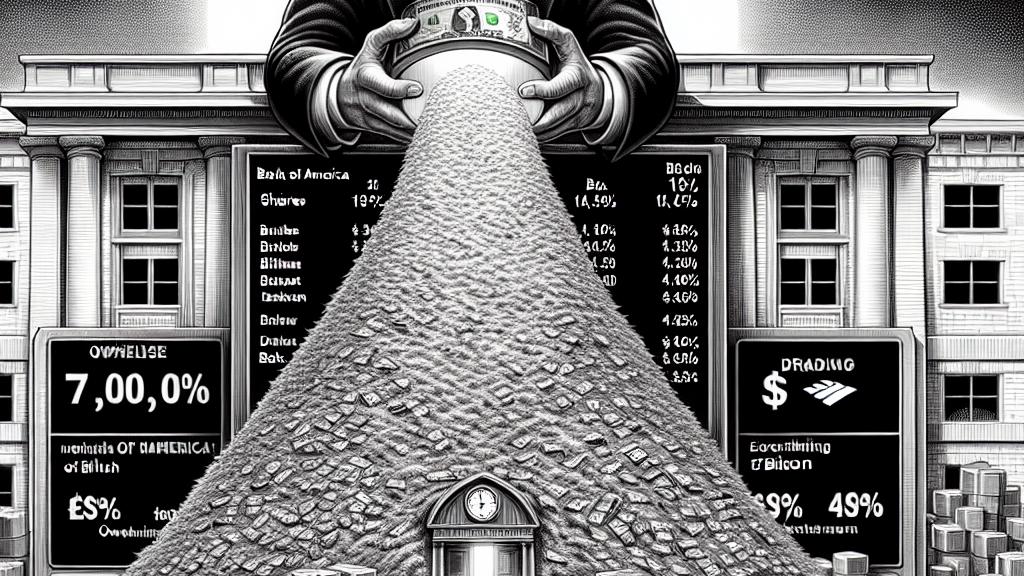

- Berkshire Hathaway strategically sells over $7 billion of Bank of America shares, reshaping its investment focus.

- Warren Buffett's astute 2011 investment transformed Bank of America, showcasing his unmatched vision.

- BofA CEO Brian Moynihan commends Buffett’s strategic influence and highlights its lasting impact on the bank.

Berkshire Hathaway’s Significant Sell-Off

In a high-stakes and well-calibrated move, Berkshire Hathaway has recently offloaded an astonishing over $7 billion worth of Bank of America shares. This dramatic decision, made over a span of 12 consecutive trading sessions, has slashed Berkshire’s ownership in BofA to approximately 11%, marking a significant shift in its investment strategy. With the sale of more than 174 million shares, Berkshire showcases its remarkable ability to adapt to ever-changing market dynamics. The rationale behind such a decisive maneuver not only aligns with Buffett’s philosophy of value investing but also emphasizes the importance of seizing opportunities in real-time, thus reinforcing his reputation as a savvy market navigator.

Buffett: The Visionary Investor

Warren Buffett, often referred to as the Oracle of Omaha, continues to inspire investors around the world with his insightful strategies and keen market awareness. His initial investment of $5 billion in Bank of America during the tumultuous landscape of 2011 stands as a testament to his forward-thinking approach. At that time, BofA was entangled in financial distress, making Buffett's confidence stand out remarkably. Fast forward to today, and shares purchased at around $5.50 have soared, showcasing an impressive increase in value. This nearly tenfold appreciation not only exemplifies Buffett's investing acumen but also reflects his ability to perceive potential amid uncertainty. Such visionary investments solidify his status as a legendary figure in the realm of finance.

Moynihan's Respectful Acknowledgment

In a recent industry conference, Brian Moynihan, the CEO of Bank of America, took a moment to acknowledge the profound impact Warren Buffett has had on the bank’s resurgence. He remarked, "Warren’s bold investment was pivotal in restoring confidence at a critical juncture for our institution." This statement not only underscores Buffett's influential role but also highlights the respect mutually shared between the two leaders. Even as Berkshire Hathaway continues its share sell-off, Moynihan exudes optimism, expressing faith that the market has the resilience to absorb these changes. His recognition of Buffett's strategic insight further cements their collaborative relationship and highlights the transformative legacy of one of the most successful investors of all time.

Loading...