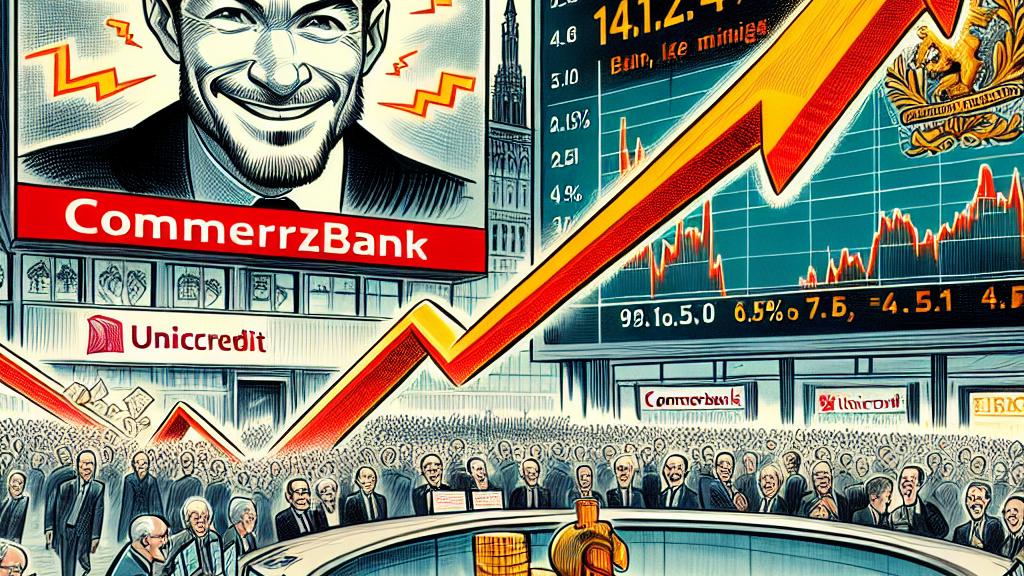

Skyrocketing Shares: Commerzbank Soars as UniCredit Steps in!

Overview

- Commerzbank's shares soared dramatically by 17% after UniCredit seized a strategic opportunity to acquire a 4.5% stake from the German government.

- This remarkable transaction not only reflects a pivotal shift in ownership dynamics but also signals renewed investor confidence in the bank's future.

- As speculation mounts about a potential takeover, UniCredit’s increased stake reignites excitement in the competitive landscape of banking.

Commerzbank's Stock Surges

On an electrifying morning on September 11, 2024, the bustling financial market in Frankfurt, Germany, erupted with enthusiasm as Commerzbank's stock price skyrocketed by an eye-popping 17%. This sudden surge was primarily fueled by Italian banking giant UniCredit's bold decision to purchase a 4.5% stake, translating to about 53.1 million shares for a whopping 702 million euros. This maneuver not only symbolizes UniCredit's confidence in Commerzbank's resurgence but also marks a significant turning point in the government's gradual exit strategy from its previous ownership position. After witnessing the bank weather the storm of financial crises, investors are reassured; they see Commerzbank evolving from a once-troubled institution to a flourishing entity ready to navigate the marketplace independently.

Transforming Government Ownership

The implications of the stake sale resonate deeply within the financial community. The German government, a formidable guardian that injected a staggering 18.2 billion euros during the 2008 crisis to rescue Commerzbank, has now embarked on a well-calculated path towards reducing its ownership. Although reduced to about 12%, the government still holds the title of the largest shareholder, which creates an interesting dichotomy reminiscent of a protective parent watching their child become self-sufficient. Public statements from Eva Grunwald, managing director of the federal finance agency, convey a sense of optimism; she articulated that this sale reflects Commerzbank standing strong, akin to a ship finally unmoored, ready to sail into open waters of financial independence and innovation amidst stiff competition in the sector.

Whispers of a Potential Takeover

In the wake of UniCredit's acquisition, speculation about a potential takeover of Commerzbank has ignited a lively discussion among analysts and investors alike. With a European footprint already established through HypoVereinsbank, UniCredit's growing interest may suggest ambitions that extend beyond investment. Analysts point out that this situation draws parallels to pivotal moments in banking history where mergers have transformed mere players into titans of the industry. The excitement among market watchers is palpable as they ponder the potential ramifications of such a merger or takeover—think of it as a dramatic movie plot where two leads join forces to become an unstoppable force. As the financial narrative unfolds, everyday investors and seasoned analysts alike find themselves on the edge of their seats, eager to see if this tale will culminate in a historic shift in the banking landscape.

Loading...