UK Motor Finance Industry Faces Major Challenges Ahead

Overview

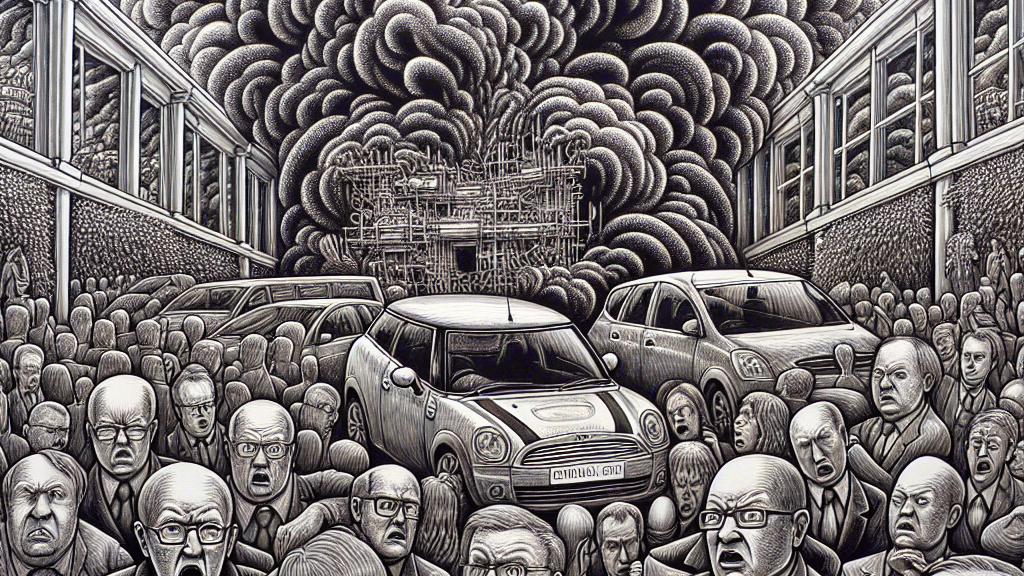

- A dramatic court ruling has thrown the UK’s car finance sector into chaos.

- Numerous banks have paused lending to grapple with complex legal challenges.

- Projected losses could be in the billions, reminiscent of previous financial scandals.

Court Ruling Shakes the Industry

In an unexpected twist, the UK’s motor finance industry is currently facing turmoil following a landmark ruling by the Court of Appeal. This court determined that car dealers must obtain informed consent from customers before accepting bonuses from banks—a critical decision that has sent shockwaves throughout the sector. Just envision how unsettling it must feel for banks and dealers alike! This ruling has prompted serious comparisons to the infamous Payment Protection Insurance (PPI) scandal which, as many remember, cost banks over £50 billion. The ramifications of this decision are profound, as they indicate a paradigm shift in the ways car financing might operate going forward. This could very well be a turning point in the history of financial services in the UK.

Banks Hit the Brakes

In response to this seismic shift, multiple significant players in the sector—including Lloyds and Honda Finance Europe—have decided to halt new lending initiatives. This cautious strategy highlights their urgent need to reassess the potential legal ramifications of continuing business as usual. Analysts are sounding alarms about the financial fallout, warning that if the Supreme Court upholds this decision, the projected losses could skyrocket to £28 billion! Can you imagine the ripple effect this would trigger across the automobile market? It could lead to a situation where consumers face not only higher vehicle prices but also significantly fewer financing options, making the dream of car ownership feel even more out of reach for many.

Looking Ahead: A Changing Landscape

As we gaze into the future, the impacts of this crisis appear both daunting and transformative for the entire automotive finance industry. A tighter lending environment is just around the corner, likely requiring consumers to navigate an increasingly complex landscape with fewer financing options and raised costs. Moreover, the consequences of this ruling could extend beyond motor finance, affecting a variety of lending sectors and introducing a wave of uncertainty that the UK economy can ill afford. The Financial Conduct Authority (FCA) is now faced with the monumental task of deciding its next steps, and the world will be watching closely. What happens next could define the road ahead for all parties involved: lenders, consumers, and the industry as a whole. With stakes this high, the future of motor finance is at a crucial juncture, ultimately forcing everyone to rethink what they thought they knew about financing a vehicle.

Loading...