Reasons Behind the Significant Increase in Perceived Prices

Overview

- Consumers feel the pang of rising living costs, despite government statistics indicating only slight inflation.

- Significant price hikes in real estate, automobiles, and electronics starkly illustrate this economic phenomenon.

- The disconnect between consumer experiences and government data has fostered widespread skepticism and frustration.

Contextual Background: Navigating Japan's Economic Landscape

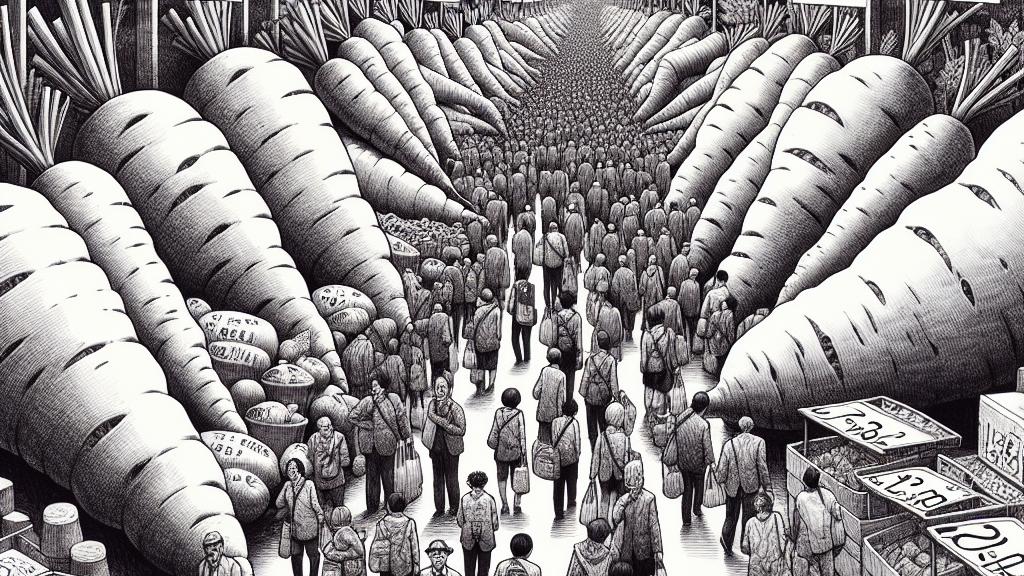

In Japan, a palpable sense of economic strain pervades everyday life, as citizens confront the relentless reality of rising expenses. Although officials proclaim an inflation rate hovering around the stable 2% mark, this statistic feels almost misleading to many. For instance, shoppers have likely noticed hefty increases in grocery items; the price of vegetables like carrots and turnips has surged by nearly 30%. Each shopping trip feels like a trek through a minefield of ever-increasing prices, leading many to question the reliability of those official reports. Thus, the profound contrast between what statistics suggest and what people experience day-to-day creates a pervasive atmosphere of uncertainty and frustration among the populace.

Identifying Key Drivers Behind Price Hikes

Several critical sectors vividly illustrate the dramatic surge in perceived prices. Real estate stands out as a glaring example; in the heart of Tokyo, the average price of new condominiums has shockingly surpassed 1 billion yen. This concerning rise is a direct result of multiple factors: soaring construction costs, an influx of wealthy foreign investors, and escalating material prices that impact everything from wood to steel. Beyond real estate, the automobile market is also feeling the heat—new cars equipped with advanced technologies and safety features are now beyond the reach of many. Consequently, used car prices have skyrocketed as well, leaving consumers surprised at how quickly their options have diminished. Notably, electronics like iPhones have also crept up in price, driven largely by unfavorable exchange rates and production costs, compelling consumers to rethink their purchasing choices. Take, for example, the latest model which, while boasting improved features, now comes with a price tag many find daunting—the emotional weight of these decisions grows heavier each day.

The Discrepancy: Consumer Sentiment vs. Government Statistics

A stark and troubling disconnect exists between how consumers experience rising prices and how government statistics depict inflation. Despite positive reports from officials promoting a manageable inflation rate, the daily experiences of average citizens tell a different story. For example, as the price of staple products like rice and bread continues to climb, households struggle with higher bills that seem to contradict the comforting narratives offered by policymakers. Reports indicate that expenses for essentials have surged by as much as 30%, catching families off guard and forcing them to make difficult choices about what to forgo. As they grapple with these financial challenges, individuals increasingly question the accuracy of government data, leading to a growing sense of anxiety and skepticism. This frustration not only undermines trust in public institutions but also highlights the urgent need for transparency regarding the economic realities faced by everyday consumers. Ultimately, the ongoing dialogue between consumer sentiment and official statistics remains a critical issue, one demanding attention to better address the true costs impacting families across the nation.

Loading...