Understanding Bank of England's Rate Cuts and Economic Impact

Overview

- Traders are increasingly optimistic about potential multiple rate cuts by the Bank of England in 2025.

- Disappointing retail sales data highlights serious concerns regarding the resilience of the UK economy.

- High inflation and fluctuating bond markets create significant challenges for policymakers moving forward.

The Economic Context

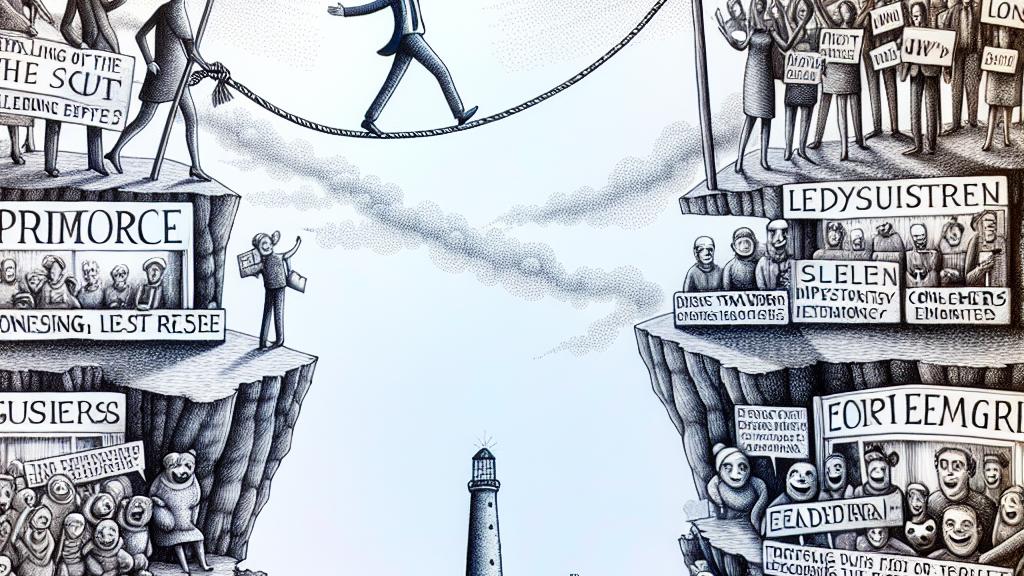

Right now, the UK economy feels like it's on a tightrope, teetering back and forth. Traders are showcasing a growing optimism, betting that the Bank of England (BoE) will need to make considerable cuts to interest rates in 2025. Just consider the retail sales numbers from December, which unexpectedly fell by 0.3%, contrasting sharply with the anticipated rise of 0.4%. This isn't merely a statistic; it’s a stark reflection of how consumers are tightening their spending due to the persistent cost-of-living crisis. For young individuals eyeing property ownership, lower interest rates could serve as a beacon of hope, making mortgages much more accessible and reviving aspirations in a daunting market.

Impact of Inflation

Inflation is another essential factor at play, and its recent trajectory has been fascinating. Soaring to shocking highs earlier, inflation is now showing signs of cooling down to a more manageable 2.5%. This presents a potent opportunity for the BoE to consider rate cuts that could stimulate economic activity. Imagine how a slight reduction in interest rates might encourage families to spend more at local shops, or persuade first-time buyers to finally take the plunge into the housing market! Yet, as rosy as this sounds, many households are still grappling with the ramifications of past high inflation. Those locked into fixed-rate mortgages may feel the weight of missed opportunities and rising living costs, highlighting a dissonance in the economic recovery narrative.

Challenges Ahead

As we peer into the future, it’s evident that the challenges ahead are not to be taken lightly. Finance Minister Rachel Reeves faces a rocky road; her mission centers on jumpstarting growth whilst managing the ballooning national debt—a task that might seem Sisyphean. The recent budget announcements, with plans for significant tax increases, add another layer of complexity to this already delicate situation. Critics are quick to voice concerns about how this could dampen consumer sentiment and spending habits. Furthermore, the unpredictable fluctuations in global bond markets could complicate the government’s plans further, potentially leading to increased borrowing costs. The upcoming BoE meeting in February is set to be a pivotal juncture. Will they opt for decisive action that could revive the economy, or will they hesitate in the face of ongoing uncertainties? One thing is certain: everyone is watching closely, and the stakes have never felt higher.

Loading...