BNP Paribas Highlights Overcapacity in European Banking Sector

Overview

- BNP Paribas emphasizes that Europe is saturated with banks, hindering competitiveness.

- Calls for strategic consolidation, invoking examples from market dynamics.

- UniCredit's aggressive pursuit of Commerzbank exemplifies sector volatility and ambition.

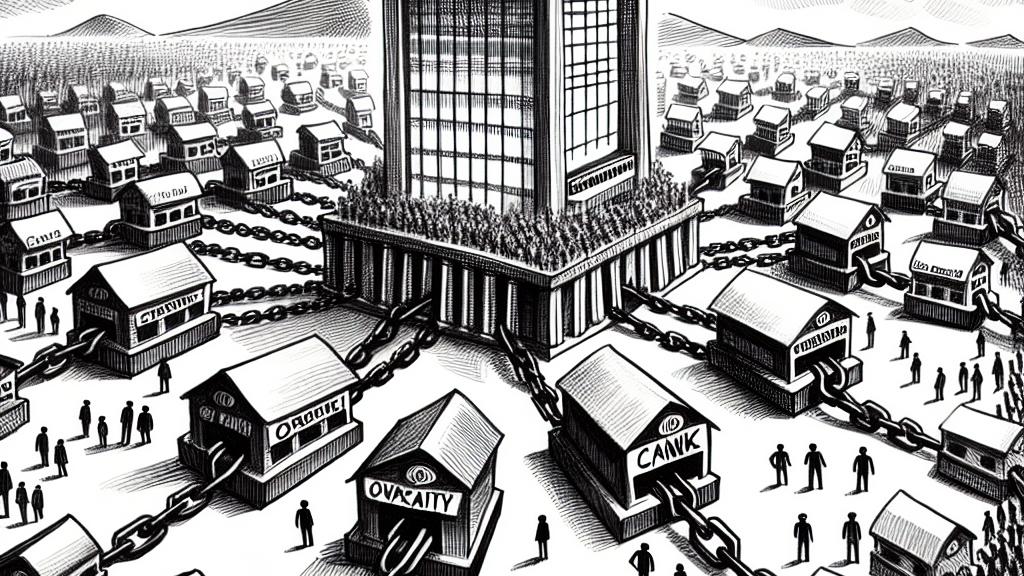

Identifying the Overcapacity Crisis

In France, BNP Paribas stands as an industry giant, echoing a critical message: Europe is overloaded with banks. Lars Machenil, the eye-opening Chief Financial Officer, candidly declared that with such saturation, genuine competition becomes stifled. He articulated, 'If anyone asks how many banks are in Europe, the correct answer is simply too many.' Such fragmentation locks regional banks in a struggle for survival, stunting their growth potential and ability to rival powerhouses like Citigroup and Wells Fargo. Hence, advocating for deeper integration among banks to form stronger entities is more than a suggestion—it's a necessity for thriving on a global scale.

Market Maneuvering: Initiatives and Opposition

Market movements reflect a compelling narrative of ambition and rivalry. Take, for example, UniCredit’s bold attempt to seize control of Commerzbank—a significant event that sent ripples through the banking ecosystem. German authorities reacted swiftly, condemning UniCredit's bid as an 'unfriendly approach,' underscoring the growing concerns over national sovereignty and the health of domestic finances. This scenario vividly illustrates how banks are not only racing to merge for stability but are also navigating a landscape fraught with political overtones. The complexity of these dynamics highlights the intrinsic challenges posed by differing national interests that turn potential mergers into real battlegrounds.

Charting a New Path: The Future of Banking in Europe

As the banking sector evolves, BNP Paribas posits a dual-track approach: fostering domestic mergers while recognizing that cross-border consolidations face significant hurdles. For instance, the faltering merger attempts between BBVA and Banco Sabadell have shown just how difficult it can be to navigate the regulatory minefield in Spain. The scene is set for a critical transformation fueled by rapid FinTech advancements, where traditional banks must adapt or risk obsolescence. While older banks cling to legacy systems, innovative financial technology firms are redefining what banking can look like. This intersection of technology and finance offers a vibrant future, rich with opportunity, yet challenging, as all players must find a way to blend innovation with reliable service to retain customer trust—a delicate balance in a fast-paced world.

Loading...