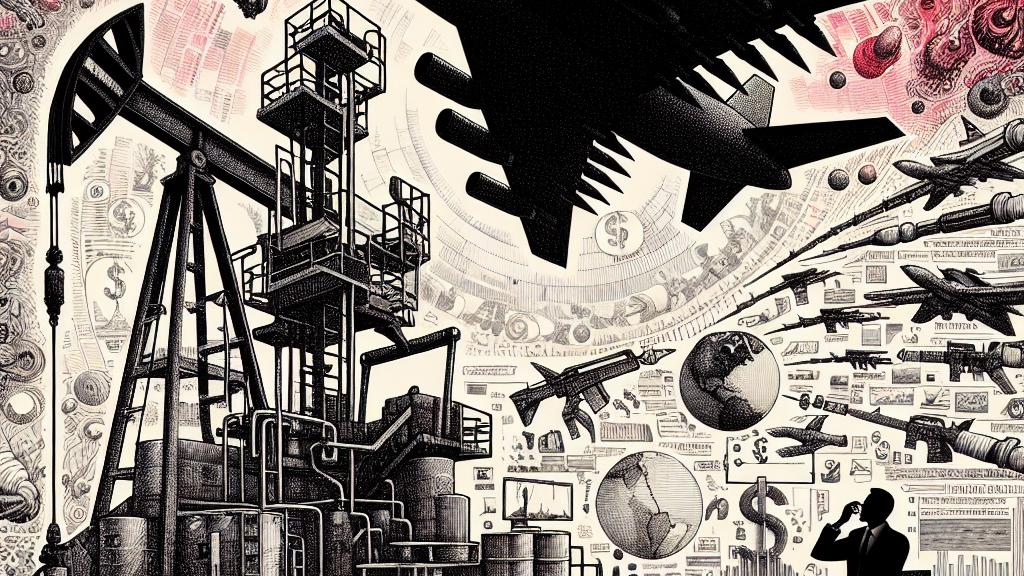

Understanding the Stability of Oil Prices Amid Middle East Tensions

Overview

- Oil prices have experienced a modest uptick despite rising tensions in the Middle East, intriguing many analysts.

- This unexpected stability largely stems from an unprecedented level of short positions held by traders, showcasing a cautious market sentiment.

- Shifting global economic dynamics and changing supply chains add layers of complexity to the pricing of oil, making it a captivating subject.

The Background of Rising Oil Prices

As October 2024 unfolds, oil prices have started to climb, driven primarily by fears that Israel may escalate military actions against Iranian oil installations. Crude futures have surged an astonishing 8% within just one week, leaving economists and traders alike bewildered by the subdued market response. In the past, geopolitical tensions of this nature typically ignited significant price spikes. However, analysts have observed a different trend this time around. Iran, a heavyweight in the OPEC landscape, holds a position where nearly 4% of the global oil supply could hinge on outcomes of these potential conflicts, leading to unease not only in oil markets but across various sectors of the global economy.

Market Reactions and Investor Sentiment

The oil market’s reaction to rising geopolitical tensions has been notably tempered, prompting a closer look into the factors at play. A significant contributor to this surprising hesitance is the sheer volume of short positions that traders have taken, betting against the rise in oil prices. According to Amrita Sen from Energy Aspects, 'We are witnessing unprecedented levels of short-selling in the oil market.' This situation points to a pervasive fear of oversupply and weakened demand recovery. However, experts caution that if market attitudes shift swiftly, prices could soar above $80 per barrel in no time. Here, the concept of 'backwardation' surfaces, describing a condition where current prices surpass future projections, hinting at the traders' anticipation of looming supply constraints.

Future Implications and Economic Considerations

When we gaze into the horizon, the factors shaping the oil market are anything but simple. The International Energy Agency (IEA) divulges that oil demand recovery is both uneven and uncertain, heavily influenced by the COVID-19 pandemic's prolonged aftermath. For instance, projections indicate that by 2026, global consumption could soar to 104.1 million barrels per day (mb/d), especially driven by emerging economies like India and Brazil. However, these nations also face pressing energy transitions toward cleaner sources, which could disrupt traditional oil demand patterns. Producers consequently face a pivotal crossroads: to invest in new capacities or to leave valuable resources untapped, potentially jeopardizing future supply availability. Clearly, the interplay of geopolitical tensions, investor behavior, and a shift toward sustainability forms a delicate balance that dictates the future of the oil market, making it an ever-evolving narrative worth tracking closely.

Loading...