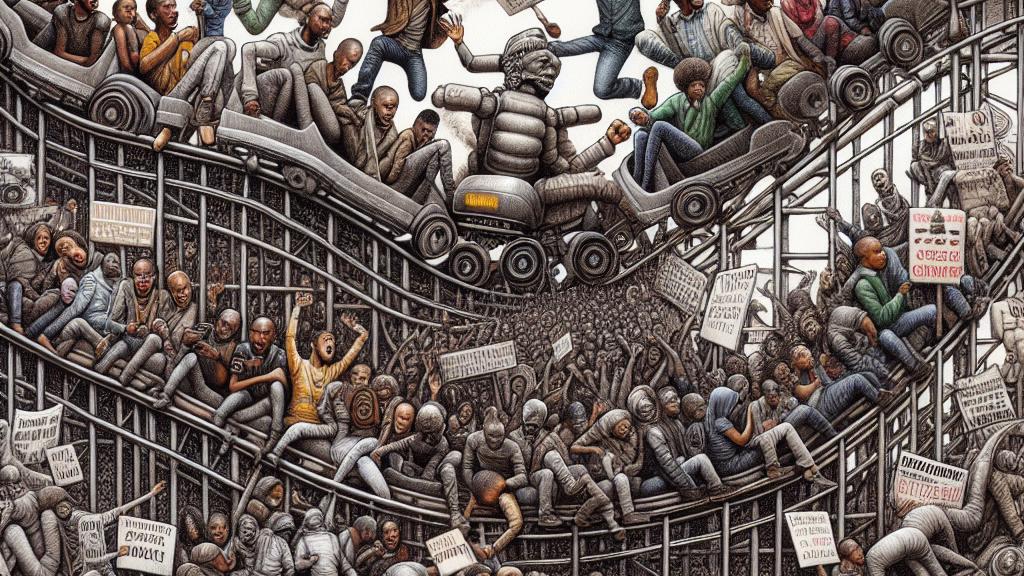

Tax Turmoil: President Ruto's Rollercoaster Ride Through Kenya's Economic Crisis

Overview

- Kenya's President Ruto faces escalating public protests against proposed tax increases amidst dire economic conditions.

- Recent court decisions have invalidated critical tax reforms, pushing the government into a fiscal crisis.

- Experts stress the need for transparent dialogue and public input in shaping future taxation policies.

Public Backlash and Intensified Protests

In Kenya, President William Ruto finds himself at the center of a fierce public backlash following his government's proposals for substantial tax increases, designed to tackle the crippling national budget deficit. The protests have predominantly been led by younger generations who feel the weight of economic hardships acutely. Utilizing social media for organization and awareness, activists have rallied together, resulting in widespread demonstrations across various cities. These graphic displays of dissent highlight not just opposition to the proposed financial measures, which many deem as economically burdensome, but also a growing frustration with the government's failure to address pressing issues like the rising cost of living. The chaos culminated in violent confrontations with security forces, further indicating a breakdown in public trust and demands for accountability.

Judicial Blow to Tax Legislative Efforts

Adding to the turmoil, recent rulings from Kenyan courts have significantly undermined the government's efforts to secure revenue through tax increases. In a ruling that sent shockwaves through the administration, the Appeals Court deemed the 2023 Finance Bill unconstitutional due to procedural oversights. This ruling comes at a perilous time for the Ruto government, as experts estimate that these legal challenges could lead to a staggering loss of over half a trillion Kenyan shillings in potential revenue. As a result, there are urgent concerns regarding the government’s ability to finance essential services. The prospect of reintroducing tax measures from the previous fiscal year creates additional complexity and uncertainty in the fiscal landscape, highlighting the need for strategic realignment and exploration of new revenue sources.

Navigating Forward: Engaging the Public in Economic Solutions

Moving forward, the path to economic recovery necessitates a paradigm shift in how the Kenyan government approaches tax policy and public engagement. Economic experts advocate for a model that encourages transparency and inclusivity by integrating public feedback into legislative processes. This could involve innovative tax structures that equitably distribute fiscal responsibilities, relieving the burden on the impoverished segments of the population. Moreover, a balanced approach to governmental spending is essential—critical sectors like healthcare and education must not suffer sacrifices amidst financial constraints. By fostering a collaborative dialogue with citizens, the Ruto administration can rebuild trust, stabilize the economy, and ensure that fiscal measures reflect the collective well-being of the Kenyan populace.

Loading...