Exploring the New Wave of Mergers in the Mining Industry

Overview

- The mining industry is experiencing a remarkable surge of merger activities that could reshape its future.

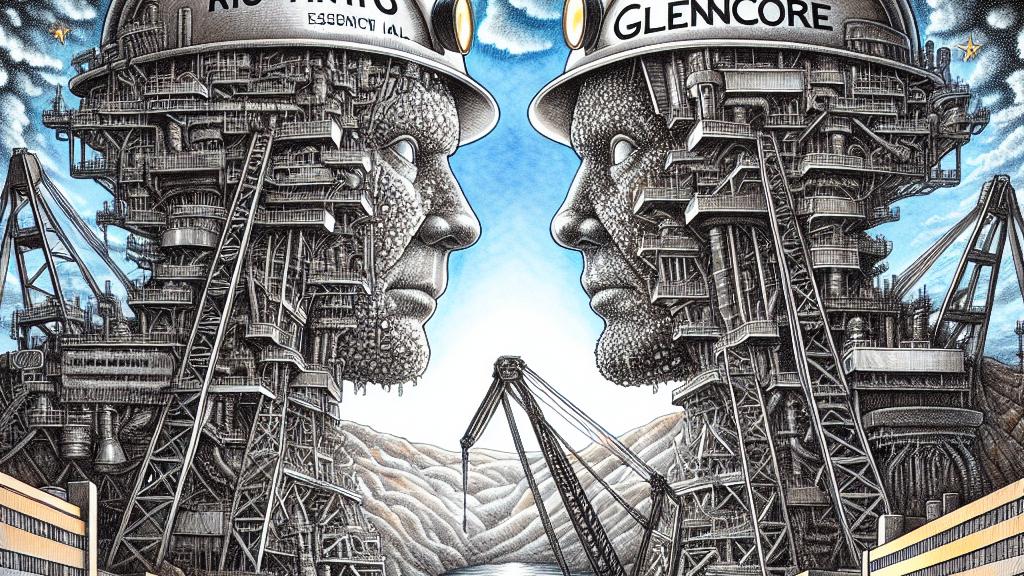

- Major players like Rio Tinto and Glencore are in talks for potentially record-setting mergers.

- While optimism abounds, analysts are cautious, expressing concerns over cultural differences and the actual benefits.

A Year of Mergers: Setting the Stage

As we step into 2025, the mining sector is bracing itself for what could be an unforgettable year of mergers and acquisitions. Picture this: the prospect of a merger between Rio Tinto and Glencore—a deal that, if finalized, would not only set a historical precedent but also create a new industry titan with a staggering market value of about $150 billion! This merger has the potential to surpass BHP, currently the industry leader, and signal a monumental shift in market power. Why is this happening? Well, as the demand for essential metals skyrockets, especially for electric vehicles, mining companies are realizing that they must collaborate to thrive. By joining forces, they can leverage resources and expertise to meet the growing global appetite for metals vital in the transition to renewable energy.

Skepticism: A Cautious Perspective

However, it’s essential to approach these mergers with a healthy dose of skepticism. Industry analysts are voicing concerns that could dampen the excitement surrounding the proposed marriage of Rio Tinto and Glencore. For one, the two firms operate under distinct corporate cultures that might clash, complicating efforts to integrate their operations. Maxime Kogge, a sharp equity analyst, highlighted how the lack of overlapping assets raises serious questions about the actual benefits of this potential merger. As Kogge pointed out, both companies could struggle to find common ground. And let’s not forget the unique strategic positions they hold on coal assets; this difference could turn out to be more of a hurdle than a stepping stone. In light of these challenges, many experts argue that simply merging might not be the golden ticket to success that some envision.

Driving Forces Behind Mergers: The Bigger Picture

So, what’s really propelling this wave of mergers across the mining landscape? At the forefront lies an insatiable global demand for crucial resources like copper and lithium—two metals that are pivotal in the shift toward renewable energy solutions. The dramatic rise in electric vehicle production has led forward-thinking companies to scramble for supplies of these essential materials. A striking example is the recent merger between Piedmont Lithium and Sayona Mining, a strategic move aimed at establishing them as North America’s largest lithium producer. This merger is not just about combining forces; it represents a calculated strategy to secure a competitive advantage in an evolving market. Through such collaborations, the mining industry is making a bold statement—it’s adapting and evolving, ensuring that it remains a key player in the crucial transition to sustainable energy solutions. These moves indicate that the sector is not merely looking to survive; it’s striving to thrive in a rapidly changing world.

Loading...