Thai Stocks Surge: The Comeback Story of a Market Long Forgotten!

Overview

- Thai stocks achieve remarkable gains, signaling a shift towards improved market conditions.

- The resurgence of the Shinawatra family in politics boosts investor confidence in Thailand's economic future.

- Proposed economic reforms and initiatives aimed at stimulating growth may revitalize consumption and investments.

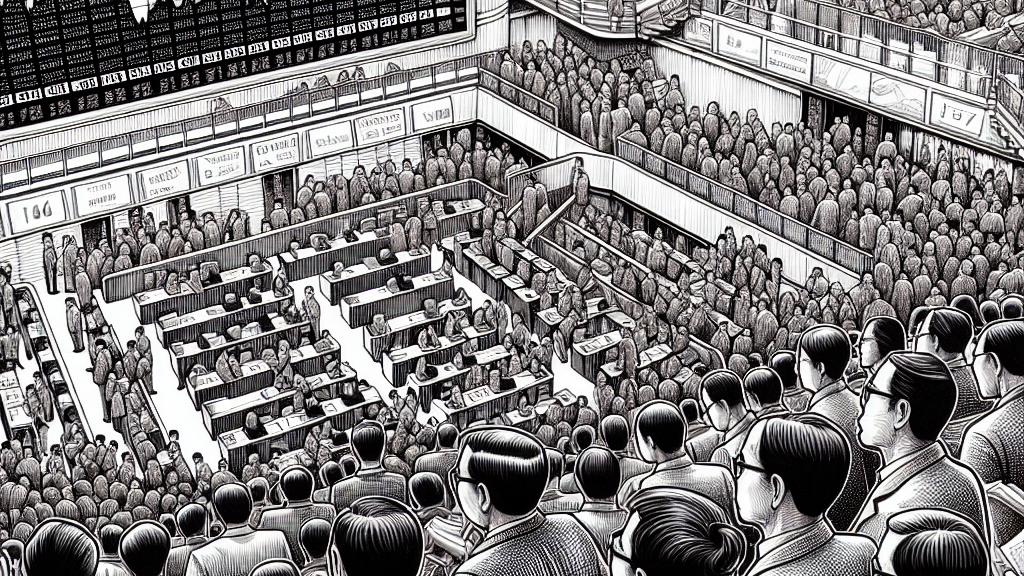

A Turning Point for Thailand's Stock Market

In Thailand, the Stock Exchange of Thailand (SET) has showcased a remarkable comeback. As of August 23, 2024, the index closed at 1,354.87, reflecting a substantial 4% increase over the week. This performance marks the best weekly result since early 2021, powered by a wave of investor optimism following the election of Paetongtarn Shinawatra as prime minister. Analysts believe that her family's historical focus on populist policies and rural development is key to rekindling investor confidence in a market that has had its fair share of ups and downs.

Renewed Investor Sentiment and Economic Initiatives

Investor sentiment in Thailand is progressively improving as political stability returns. The previous year's decline was primarily due to political unrest and dismal tourism revenues that led to foreign investors withdrawing their investments. However, the recent economic initiatives proposed by the new Shinawatra-led government—including debt restructuring plans and significant cash handouts—are reviving interest among investors. The return of Thaksin Shinawatra from exile draws considerable attention, as many believe that his influence could drive robust economic policies that stimulate consumer spending and attract foreign capital back into the Thai market.

Future Prospects: Opportunities Amid Challenges

Despite the revival of the Thai stock market, challenges remain. Even with the recent gains, the SET index is still 13% lower than its position a year ago. Analysts underline the need for a careful approach to navigating political dynamics and potential economic headwinds. Yet, many see light at the end of the tunnel, as reduced political uncertainty, strategic economic policies, and potential earnings growth present an optimistic outlook. The Shinawatra family’s historic tie to the population and their ability to push for policies that benefit the broader economy may be what Thailand's stock market needs to reclaim global competitiveness and investor trust moving forward.

Loading...