Unmasking the Mule: Thailand's Banks Tackle Financial Fraud Head-On!

Overview

- Thailand's banking sector adopts a Central Fraud Register (CFR) to combat mule accounts effectively.

- Identification of over 15,000 individuals linked to fraudulent mule accounts facilitates prevention efforts.

- Comprehensive regulatory reforms are underway to enhance consumer protection and bank accountability.

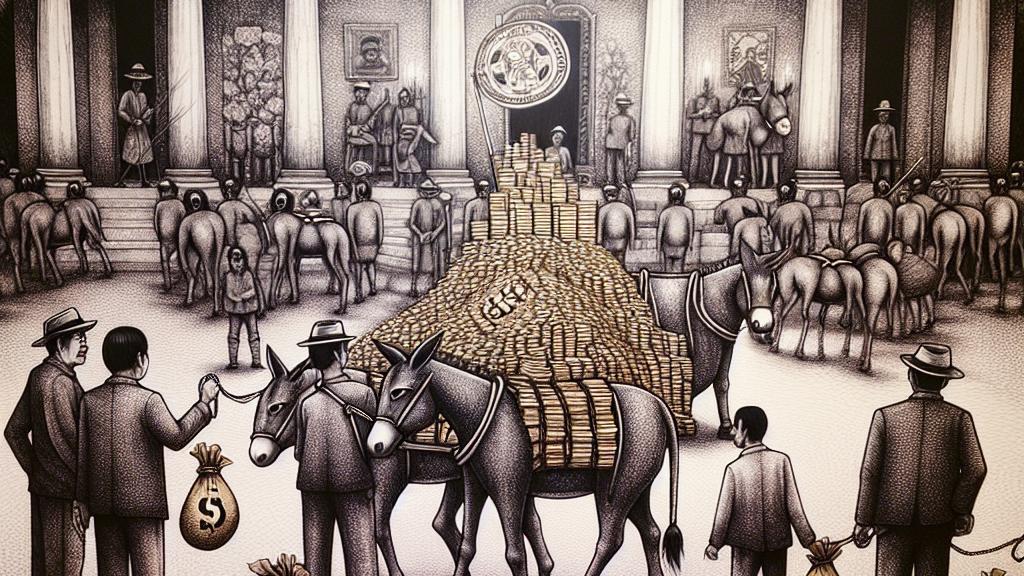

Overview of Mule Accounts and Their Impact in Thailand

Mule accounts pose a significant threat in Thailand's financial landscape, enabling illicit money transfers and complicating efforts to combat financial crime. These accounts—often linked to unsuspecting individuals who are compensated for allowing their accounts to be used—play a pivotal role in money laundering and scam operations. As the issue has escalated, the Bank of Thailand, along with the Thai Bankers’ Association, launched the Central Fraud Register (CFR) in September 2024, aiming to create a robust framework for sharing data on suspicious accounts across the banking sector, thereby reinforcing collaborative efforts to tackle financial fraud.

Key Features and Achievements of the CFR System

The CFR system marks a transformative step towards fortifying defenses against fraudulent activities. Since its introduction, over 15,000 individuals have been identified, leading to the discovery of approximately 34,000 grey mule accounts. Each participating bank has instituted stringent measures to close these accounts immediately upon detection, thus preventing individuals linked to fraudulent activities from re-establishing accounts without proper verification from law enforcement. This proactive approach not only helps disrupt ongoing scams but also enhances trust in the banking system, as consumers see direct actions taken against fraud.

Future Directions: Strengthening Regulations and Enhancing Security

The ongoing battle against financial fraud in Thailand is evolving, with regulators focusing on enhancing protective measures for consumers. The Bank of Thailand is actively exploring legal reforms to ensure that victims of fraud receive full compensation if banks fail to identify fraudulent transfers proactively. This initiative reflects a global trend towards greater accountability within the banking sector. Additionally, the introduction of stricter security measures, such as facial recognition for significant transactions, aims to thwart the misuse of mule accounts. As Thailand moves forward, these efforts underline a commitment to creating a secure banking environment that safeguards both consumers and the integrity of the financial system.

Loading...