Bangkok's Economy on Edge: Will Delays Trigger a Rate Reduction?

Overview

- Thailand's economic stability is threatened by potential delays in the digital wallet initiative.

- The Bank of Thailand may respond to slowed consumption with early interest rate cuts.

- Retail sectors could see a boost if alternative stimulus measures are implemented efficiently.

Understanding Thailand's Economic Challenges

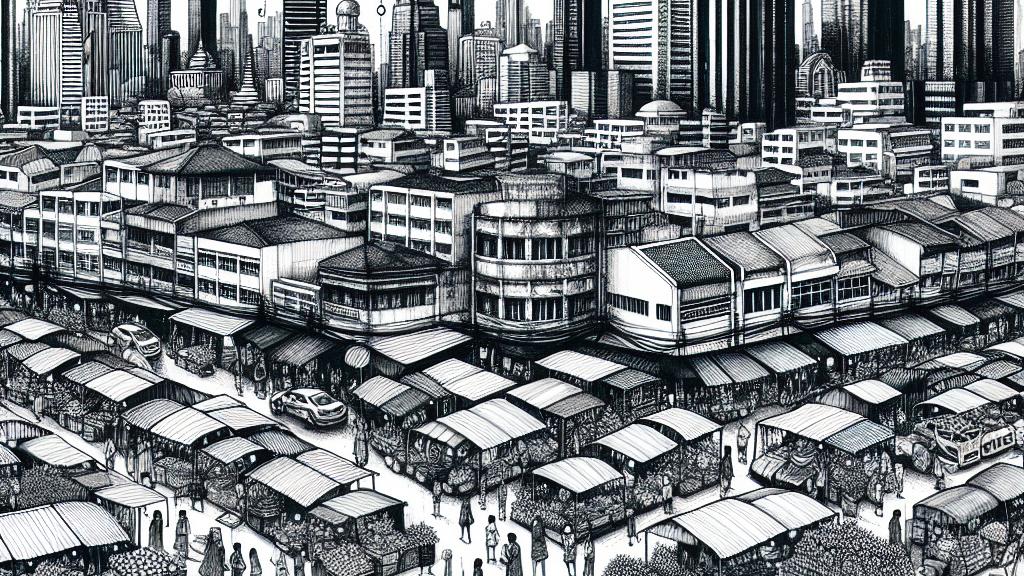

In Thailand, particularly in the bustling city of Bangkok, economic challenges are becoming increasingly evident. As the Thai government considers delaying the rollout of the 10,000-baht digital wallet initiative, experts caution that such a delay could hinder consumer spending, a vital driver of the economy. Private consumption has already shown signs of slowing down, which could lead to a reduction in economic activity. The digital wallet, intended to inject cash directly into citizens' wallets, would have provided an essential boost amidst the ongoing recovery from the pandemic. Without it, both households and small businesses may struggle, creating a ripple effect that could stall broader economic growth.

Policy Responses and Economic Forecasts

In light of these economic pressures, the Bank of Thailand (BOT) is contemplating adjustments to its monetary policy. Although the current policy interest rate stands at 2.5%, signs of weaken private investment are prompting the Monetary Policy Committee (MPC) to exhibit a more cautious tone. Analysts from BofA Securities predict that if the economic indicators continue to point downward, the BOT might enact rate cuts earlier than previously anticipated—potentially as soon as December 2024. Such a decision would aim to foster an environment conducive to borrowing and spending, critical for stimulating economic activity in Bangkok and beyond. Additionally, proactive fiscal measures could mitigate the adverse effects of the delay on public sentiment and spending habits.

Retail Sector Prospects Amid Policy Shifts

The anticipated policy adjustments present a mixed bag of challenges and opportunities for Thailand's retail sector. Should the digital wallet be delayed, the expectation of alternative government stimulus measures could provide a much-needed lifeline for retailers. Economists at CGS International Securities suggest that if additional measures succeed in bolstering consumer confidence, the retail sector may experience a resurgence. With an environment of lower interest rates on the horizon, consumers could feel more inclined to spend, leading to an uptick in retail sales. However, the sector must also contend with challenges such as rising labor costs from minimum wage increases, which could affect profitability. Retailers will need to adapt quickly to capitalize on potential benefits while managing operational expenses effectively to maintain margins.

Loading...